Virat Kohli, the legend of cricket, is known not just for the cricket but also for his entrepreneurial journey. Most people knew that he owns a couple of brands and has invested in many startups and made good amount of money. He started his own ventures as wrogn, One8 and so on. But the recent news regarding the investment that he made, almost grabbed attention from various parts of the world. Why? What’s so special in that? Well, if you look at the news it’s not so special but if we dig deeper, it reveals a very insightful direction.

Well for this, first let’s look at what is the news first? Virat Kohli has instead invested ₹40 crore (~ 1.94% stake) in Agilitas Sports. This is the news. But it has several other connections to it. To understand the story in and out, let’s first understand about Agilitas Sports.

Agilitas Sports was born in 2023 out of a rare combination of experience, timing, and ambition. Abhishek Ganguly is the founder who spent nearly two decades shaping Puma India into one of the country’s most successful sportswear stories, along with his longtime colleagues Atul Bajaj and Amit Prabhu, who handled the brand’s sales, operations, and finances. After years of building a global giant’s success in India, the trio decided to take their playbook and create something of their own: a homegrown sportswear platform with global aspirations. That’s how Agilitas was born. But for your clarity, it was not started as a small-scale company and then slowly gained traction. It has played the game in a very strategic manner.

In September 2023, barely months after its launch, Agilitas Sports, which was co-founded by former Puma India & Southeast Asia MD Abhishek Ganguly, took a bold move that signalled that the company is all set to disrupt the industry. The company announced it acquired Mochiko Shoes, India’s largest and first BIS-certified sports footwear manufacturer, for an undisclosed sum. On paper, it’s a supplier buyout, but in reality, it’s a clear masterstroke in vertical integration.

You know, for a sports wear or even a clothing brand, what they do first is launch a brand by white labelling their products. But this is a bit of a different story. Mochiko is the invisible engine behind some of the world’s biggest sportswear names, manufacturing for Adidas, Puma, New Balance, Skechers, Reebok, Asics, Crocs, Decathlon, Clarks, and US Polo. Interesting, right? So, when Agilitas acquires it, what happens? Agilitas will instantly inherit world-class manufacturing capability, operational excellence, relationships with global giants, and assets that most brands spend decades building. So, in a very short period they made it simpler by playing it strategically.

Wait, that’s just one part of the story. It is not just a capacity expansion, but it is about controlling the entire value chain from design and R&D to production, quality control, and speed-to-market. By owning Mochiko, Agilitas eliminates dependence on third-party manufacturing, gains pricing power, and secures a platform to scale rapidly both domestically and globally.

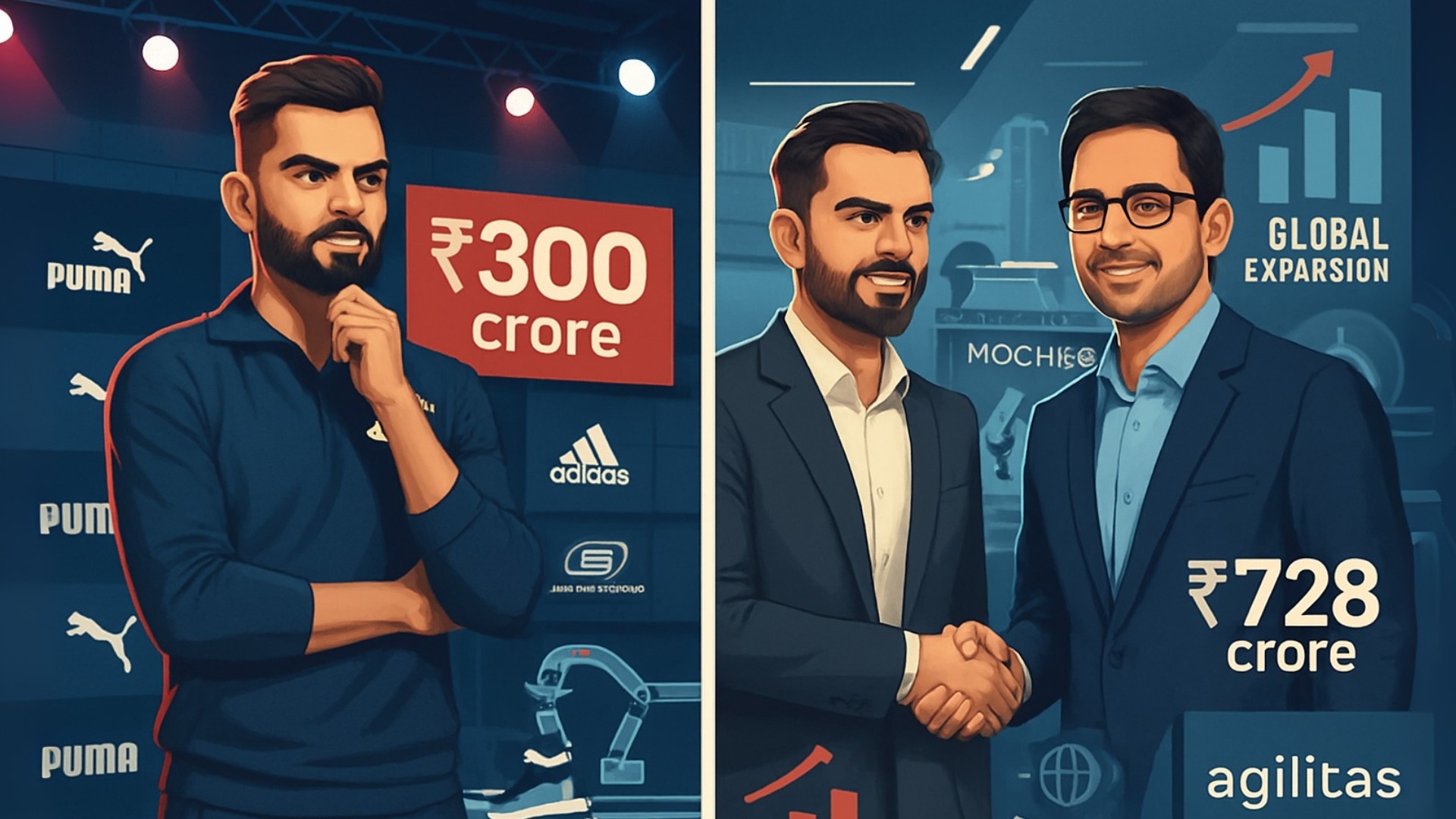

Now here’s where the story gets really interesting. The founders of Agilitas came from Puma, and if you remember, Virat Kohli was Puma’s big brand ambassador from 2017. Back in 2017 the deal was made with Kohli for a whopping 110 crore for 8 years. So, from 2017 to 2025, Kohli remained as the face of Puma. But after the deal was ended, according to several sources, Puma came back with an even bigger offer, almost ₹300 crore, to keep him as the face of the brand.

Most people would have signed that, but Kohli didn’t. He said no to the offer and instead invested ₹40 crore into Agilitas for a small ownership stake of about 1.94%. Why? Because this way, he’s not just a model wearing the shoes, but he’s a part-owner of the company. He gets to have a say in how products are designed, how the brand grows, and even how he takes his own brand, One8, global.

And most importantly, Agilitas is not just a random startup like any other. It is run by the same people who made Puma big in India, and also, they own Mochiko (the giant manufacturer for Adidas, Puma, Skechers, etc.), and it has the rights to sell Lotto in India, Australia, and more. So Kohli is basically teaming up with experts who already know how to win in this game.

It’s a smart move because an endorsement deal pays you only till the contract ends. But owning part of a brand means if the company grows, your wealth grows too. That’s exactly how Roger Federer made a fortune with the Swiss shoe brand On. Kohli is betting that being an owner in Agilitas will be worth far more than any ₹300 crore ad deal in the long run. And according to several reports, this ₹40 crore investment is just a start, and Kohli may invest even more into the company.

So, when we connect all the dots, it is a great gameplay by Agilitas. From supply chain to even selecting their investors and ambassadors. At the time of acquisition, Mochiko had recorded a revenue of ₹642 crore in FY 2023 and was projected to grow around 30% year-on-year. Driven by this acquisition and underlying contracts, Agilitas quickly scaled into a ₹700–800 crore business, with ₹728 crore in annual revenue in the year ending March 2024. This rapid scaling underscores how owning Mochiko instantly gave Agilitas strong manufacturing cash flow and credibility before even launching its own consumer brands.

If they play this right, Agilitas could be the biggest Indian sportswear powerhouse to compete on a global level. Let’s wait and see how Agilitas plays the game in the future.

Also Read: The Rise of Venture Studios: Are They the Future of Startup Creation