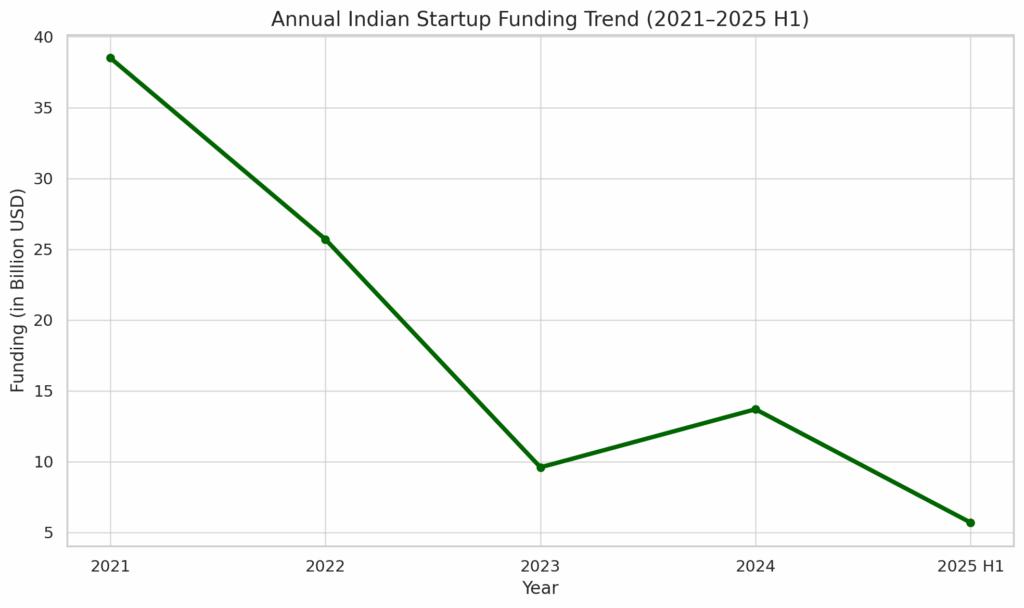

Indian startups raised over $300 million in just 7 days. In the last 10 days one unicorn was born, making it the 124th unicorn startup of India. In just a 7-day span, which is from June 30th to July 5th, over 20 startups together raised over $314.6 million. Even if we go back a week before, over 22 startups raised $278.3 million together. Meaning in just a 2-3-week span, Indian startups raised over half a billion dollars in funding. This is great news for the Indian startup ecosystem. After a sharp correction over the past two years, this capital influx suggests a shift in sentiment. Investors appear to be recalibrating their strategies, moving away from stats and metrics and toward businesses built on strong fundamentals. If you go back and understand the funding cycle, it clearly shows that Indian startups are now heading towards a positive funding scenario. The funding spree was so high in the year 2021, as startups raised over $38.5 billion, and the next year there was a decline, and they raised over $25.7 billion. But in the year 2023, there was a huge decline in funding, which resulted in overall funding falling below the levels of 2019, and it stood at $9.6 billion in 2023. But the year after a great decline, Indian startups made a strong comeback in 2024, collectively raising $13.7 billion. But before we understand the present scenario, first understand the 2024 scenario so that we can understand what will happen next.

The recovery in Indian startup funding is not a coincidence, but it’s the result of a natural correction and evolution in the ecosystem. After the unsustainable funding boom of 2021, the market faced a sharp downturn in 2022–2023 that forced a much-needed reset. Inefficient startups either shut down or restructured, and investor expectations became more grounded. There are several reasons for the recovery. Firstly, investor strategies have evolved. Venture capitalists are no longer chasing vanity metrics or unrealistic valuations; instead, they are backing startups with real traction, sustainable cash flows, and well-defined unit economics. Secondly, India’s macroeconomic fundamentals remain strong, with steady GDP growth, digital adoption, and a vibrant consumer market that still holds massive untapped potential. Third, there’s a noticeable shift in where the money is flowing. Sectors like climate tech, edtech, electric mobility, deeptech, AI, agritech, and SaaS are now at the forefront, replacing the overfunded, hype-driven sectors of the past.

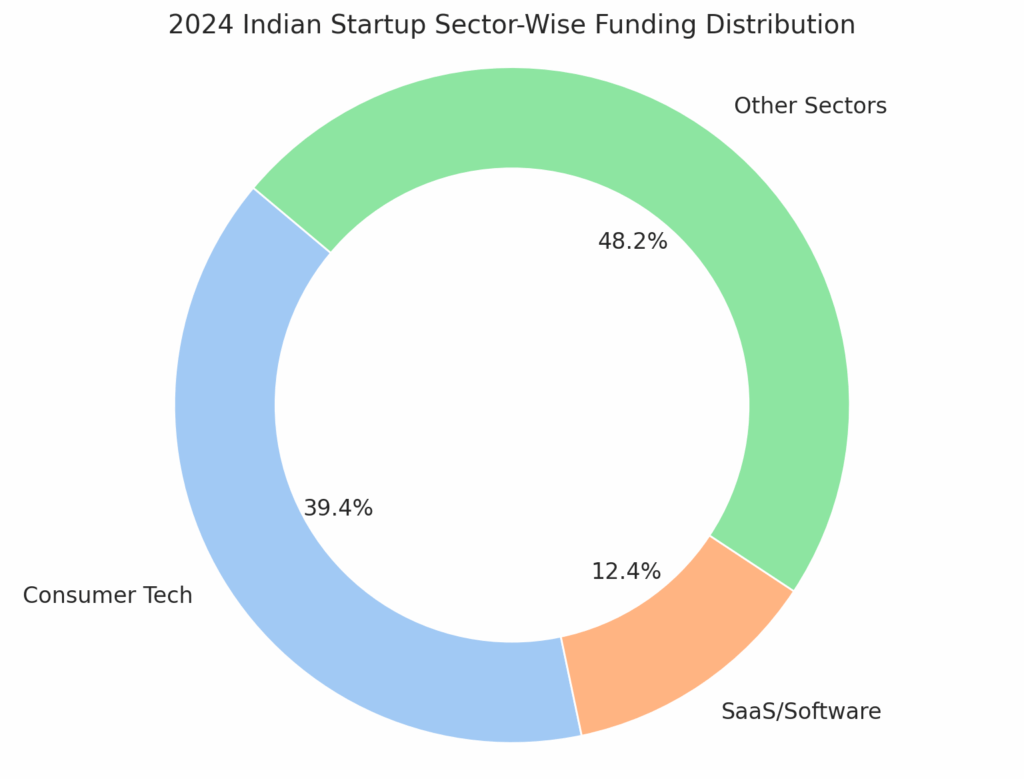

If we look closer at the 2024 funding scene, it’s clear that investors changed their approach. Nearly 80% of all startup deals were small, and they raised below $10 million, which clearly shows that investors are backing early-stage ideas and being more cautious. Big-ticket deals (above $250 million) actually dropped by around 20% compared to last year, proving that the era of oversized rounds is slowing down. Because back in time many companies raised billions and millions, but today they are struggling to survive, and some were already closed. In 2024, just 10 startups grabbed nearly 25% of all the money raised, and 9 out of those were in consumer-focused businesses. Companies like Zepto, Meesho, Rebel Foods, and Rapido stood out by showing solid growth, strong business models, and smart use of money. Other sectors like healthtech, edtech, and fintech also attracted large investments. Startups like PharmEasy, Physics Wallah, and Mintifi raised money, as they are solving real problems at scale. Consumer tech made a strong comeback, with the funding in this space more than doubling to $5.4 billion; this is all because of the bigger investor bets on quick commerce, travel, online learning, and gaming. At the same time, software and SaaS companies raised $1.7 billion, driven by demand for tools like AI, automation, and global tech solutions. Not just in India but globally, this segment saw tremendous growth. But what makes this funding story interesting is traditional industries also saw a great funding boost. Industries like finance, housing, FMCG, and fashion saw strong interest.

So, what do we understand from this? This shift clearly shows that in 2024, investors were not chasing the trends, and they focused on businesses that are built to last and solve real-world problems. So, instead of calling this a recovery, we should call it a filtering year. Now let’s see what’s happening in 2025. In the first half of 2025, Indian startups raised a staggering $5.7 billion across 470 deals, according to TICE’s Startup Funding Index. This marks an 8% year-on-year increase, which reflects growing confidence and depth in the startup ecosystem. Interestingly, growth-stage deals dominated, with nearly $3 billion pouring into mature startups that are scaling efficiently. Meanwhile, early-stage funding crossed $2 billion, which indicates sustained support for innovation. In the last six months, five new unicorns were born, spanning sectors like AI, pet care, SaaS, and logistics. Transportation and logistics tech alone saw a 104% jump, raising $1.6 billion, which is a clear sign that investors are backing startups solving India’s infrastructure bottlenecks. India also climbed to become the third-most funded tech ecosystem globally, surpassing Germany and Israel, and reinforcing its position as a serious global contender. So, what’s next? The funding never stopped in any given year; the investors just focused on startups that are scalable and creating great impact. If you’re building a startup that solves real, meaningful problems, don’t worry, funding never truly disappears. The money is still there, and it’s flowing faster than ever. But it’s no longer chasing noise; it’s chasing clarity, purpose, and strong execution. So, if you’re building something that truly matters, keep building. Because the ecosystem isn’t drying up, it’s growing up.

Also Read: Dhruva Space to Supply Space-Grade Solar Power Systems for Pixxel’s Satellites