In today’s startup world, building a unicorn company is easy compared to what it was a decade or two decades earlier. We are witnessing many startups that were started 5 years ago getting unicorn valuations. But there is one company now recently making headlines as it is planning for an IPO. This company we are talking about is about 25 years old. Which was started in the year 2000 in Mumbai.

The startup we are discussing, “Fractal Analytics,” is a multinational artificial intelligence company. Fractal Analytics was founded in 2000 by a team of five, including Srikanth Velamakanni and Pranay Agrawal who continue to lead the company today. Srikanth, who had a background in engineering and finance, believed that data could help companies make better decisions. Over the years, through consistent effort and clear vision, they built Fractal into a global company that works with some of the world’s largest businesses. Today, Fractal operates out of dual headquarters in Mumbai and New York, employs over 4,000 people, and serves clients across 16+ countries. Over two decades, it has transformed itself into a global powerhouse in enterprise AI, helping Fortune 500 companies make smarter, faster, and more impactful decisions. The recent headlines about the startup going for an IPO are grabbing audience attention.

First, let’s understand about the company and its AI-led services, and let’s dive more into the company. To make artificial intelligence truly accessible and impactful for businesses, Fractal has created a dedicated product division called Fractal Alpha. This segment focuses on building ready-to-use AI tools that solve real-world problems across various industries. What makes Fractal’s approach unique is that it doesn’t just stop at software products. Fractal Alpha also includes an AI-based education platform aimed at training people, especially employees and teams, on how to understand and use AI effectively in their work.

The company’s industry reach is equally impressive. With deep expertise across verticals, Fractal delivers AI-led solutions in:

• Consumer Packaged Goods (CPG)

• Retail

• Technology, Media & Telecom (TMT)

• Healthcare & Life Sciences

• Banking, Financial Services & Insurance (BFSI)

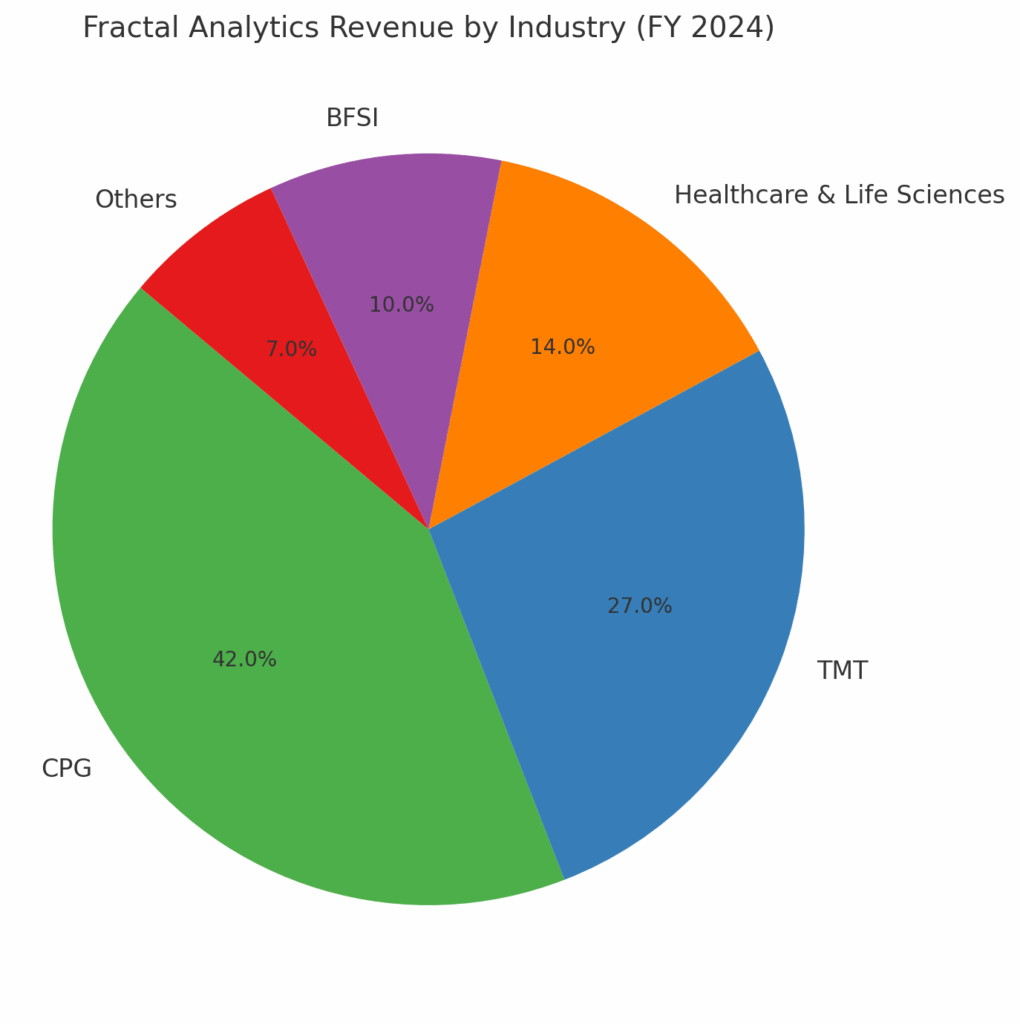

In terms of revenue contribution:

• CPG leads the pack with 42%.

• TMT follows with 27%.

• Healthcare & Life Sciences at 14%

• BFSI at 10%

• Other sectors contribute the remaining 7%.

Fractal delivers end-to-end solutions using the integrated approach, where it is all possible with the help of three core pillars. 1. Artificial Intelligence: Fractal develops AI algorithms that match and also exceed human performance in various cognitive tasks. These include pattern recognition, forecasting, natural language processing, and decision-making. 2. Engineering: Engineering is what makes these AI solutions work at scale and in real time. Fractal builds robust, cloud-native data pipelines that can connect multiple data sources, process information instantly, and feed AI models with the right inputs seamlessly and securely. 3. Design: It ensures that the right problem is being solved in the first place. Fractal uses behavioral science and human-centered design to deeply understand user behavior, decision patterns, and organizational needs.

The company has multiple AI products, such as Concordia, which is an AI-powered data harmonization platform that streamlines processes with precision and speed. There is Crux Intelligence, which is one of the most popular products of Fractal, which empowers business users to gain insights from enterprise data through an intuitive conversational experience. And these are not the only products; there are also other products, namely, Quark, Trail Run, Senseforth, Avalok, Morpheus and Kalaido These are the products that Fractal offers; all of them are powered with AI.

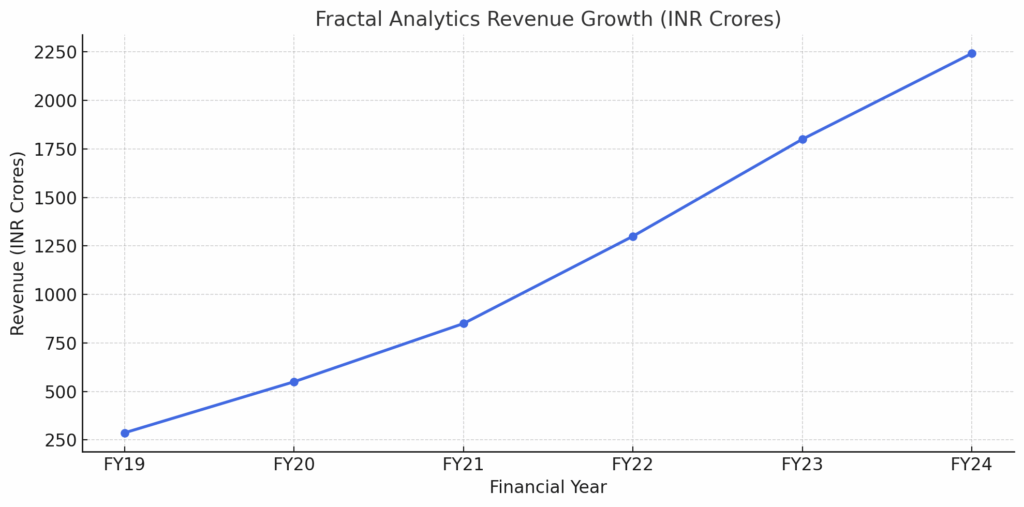

Now you might be wondering, right, if this many products are being offered by the company, how is its performance? The revenue from operation as of FY 2024 stands at INR 2,242 crores. But in the year FY 19, it was at INR 287 crores. In just five years revenues grew by 10 times. Today, Fractal Analytics generates hundreds of crores in revenue by delivering cutting-edge AI solutions to global enterprises.

But this wasn’t the case earlier. The real turning point came in 2016, when the company raised $100 million from Khazanah Nasional Berhad, the sovereign wealth fund of Malaysia. With this investment, Fractal made a strategic move by shifting from being a traditional analytics and data services firm to becoming a full-stack AI, engineering, and design powerhouse. It marked the beginning of an inorganic growth phase, where Fractal began acquiring and incubating companies that aligned with its vision of building end-to-end decision intelligence ecosystems. This phase led to the acquisition of Final Mile Consulting (a behavioral science & design firm), the development of Fractal’s proprietary AI products like Qure.ai, Crux, Samya, etc., and a deep focus on combining AI + cloud engineering + human-centered design.

With its rapid expansion and acquisitions, the company is grabbing major market share. Even the business is so diversified. As Fractal Analytics moves closer to its public debut, investor interest continues to surge. In a recent secondary transaction, the company raised $150 million, pushing its valuation to $2.44 billion. The funds were raised through the sale of a 6% stake by existing investor Apax Partners, reflecting both exit momentum and incoming faith. The buyers include 22 investors and funds, among them Trust Investment Advisors, White Oak Capital Management, and Gaja Capital. The IPO is expected to happen in 2026, but the company plans to file draft papers by August 2025. According to the sources, it is expected to raise $500 million

Also Read: How Kuku FM Became India’s Leading Vernacular Audio Platform