“Atmanirbhar Bharat” means self-reliance, which India is trying and working towards becoming. From medicines to missiles, Indian companies and the government are working towards it. Many sectors in India depend on other countries at a specific point of the value chain or product supply chain. One such industry where India is depending heavily on other countries and imports is the pharma industry. In yesterday’s article we delved deeper into the industry and figured out multiple reasons why India is relying on imports and how it is getting impacted.

This article is a continuation of it, where we will understand what the Indian government is doing to tackle this issue and what Indian companies and startups are doing. Whenever we talk about the Atmanirbhartha, the first scheme that comes to our mind is the “PLI scheme”. For those who don’t know, it stands for Production-Linked Incentive Scheme. It is a government scheme designed to boost manufacturing and attract investments. The main aim is to make Indian companies and manufacturers globally competitive, increase their production, and be a part of the economic growth.

The Indian government introduced the PLI scheme for the pharmaceutical industry back in September 2020. Under this scheme, the government has given an outlay of INR 15,000 crore. This scheme is for over 9 years, starting from 2020-21 to 2028-29. The main aim of this scheme is to enhance India’s manufacturing capabilities, increase its product portfolio, and also to support domestic production. The scheme has provided financial incentives for the pharmaceutical products across three main categories. One is biopharmaceuticals and patented drugs; next are active pharmaceutical ingredients and drug intermediates; and last are various therapeutic drugs and also in vitro diagnostic devices.

Let’s dig deeper and understand what has happened in the APIs and KSMs segments. After the PLI scheme was launched, the financial outlay of over INR 6940 crore was allotted to these KSMs, DIs, and APIs. The main objective of this outlay is to reduce the import dependence of over 41 identified bulk drugs; with this, India wants to manufacture its critical key starting materials, drug intermediates, and active pharmaceutical ingredients. There is some progress happening in this segment, such as under the PLI scheme for bulk drugs, 48 projects have been selected for the scheme, and amongst them, 34 were commissioned for almost 25 bulk drugs. Even the investments have crossed the initial targets, surpassing the initial commitment of INR 3,938 crores and standing at INR 4,253 crores.

There are some projects granted permissions to manufacture APIs, especially for penicillin G. It is essential for several antibiotics. Penicillin G is a foundational API used in multiple antibiotics, and for decades, India has been importing it from China. Interestingly, we import over 6000 tons of this API. A massive ₹1,910 crore investment is being made in Kakinada, Andhra Pradesh, to bring back Penicillin G production. This alone is expected to lead to an import substitution worth ₹2,700 crore annually.

Clavulanic Acid project in Nalagarh, Himachal Pradesh, with an investment of ₹450 crore, this project is expected to substitute imports worth ₹600 crore annually. Clavulanic acid plays a crucial role in modern medicine as an antibiotic booster; it is commonly combined with penicillin-group antibiotics to overcome bacterial resistance. India’s pharma development is not just driven by government schemes; it’s equally fueled by private-sector and startup innovation. Companies like Dr. Reddy’s, Lupin, Biocon, and Aurobindo are making strategic API investments and backward-integrating to reduce foreign dependence.

Notably, Dr. Reddy’s has set around ₹1,500 crore in capital expenditures for FY 23, focusing heavily on biosimilars, injectables, and expanding backward-integration capacities, highlighting the intent to insource vital API processes over the next several years. The company now operates nine API manufacturing units, including six in India, and produces nearly 60% of its own API requirements in-house. Among deep-tech startups, Bugworks Research stands out. With an $18 million Series B1 raise in February 2022, Bugworks is advancing its lead candidate, BWC0977, a broad-spectrum antibiotic for hospital-acquired infections.

Then there are String Bio and Enzene Biosciences, pioneers in enzyme catalysis and fermentation-derived APIs, which reduce waste, cost, and environmental impact relative to traditional chemical synthesis. While specific funding figures are not public, these firms operate within government-supported biotech clusters such as C-CAMP and contribute significantly to diversifying India’s chemical production ecosystem.

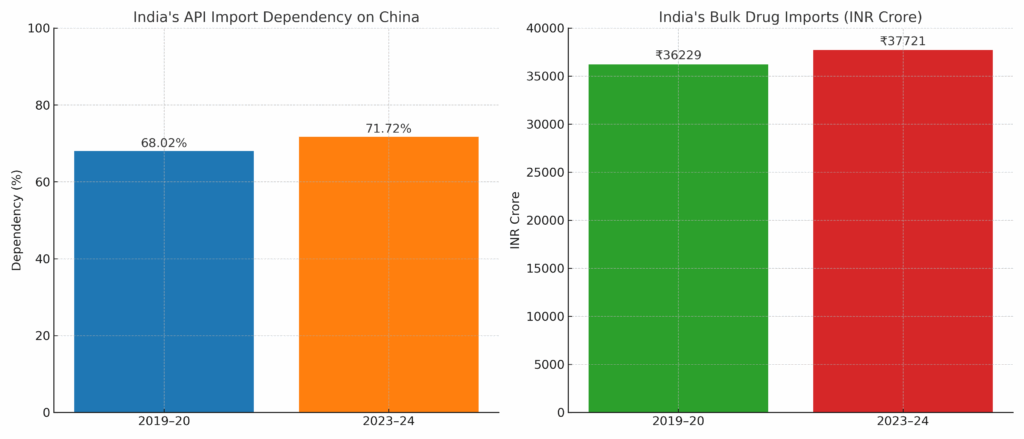

But despite these efforts by companies and the Indian government, the import dependence has increased over the period. India has registered a rise of 4.12% in overall imports of bulk drugs and intermediates. During the FY 2023-24, it stood at INR 37,721 crore compared to the previous fiscal year’s INR 36,229 crore.

Interestingly, the dependence on China has increased over the last five years. In 2019-20 it stood at 68.02%, but it rose to 71.72%.

In summary, of the imports, India has imported over 451,894 MT of pharma raw materials, out of which 344,053 MT was from China.

But again, coming to the question, why are we still holding back?

1. Environmental Regulations & Pollution Laws

The chemical processes involved in API and KSM manufacturing are often highly polluting, producing toxic waste and effluents that require expensive treatment and disposal. India has strict environmental laws under the Environment Protection Act, 1986, and stringent compliance with CPCB (Central Pollution Control Board) norms.

Setting up an API/KSM unit in India often requires multiple clearances (Environmental Impact Assessment, Consent to Establish, Consent to Operate). But when it comes to providing subsidized land, power, water, and more relaxed environmental norms, which makes it easier for them. But India’s cleaner production technology is making it expensive.

2. Highly capital intensive and lower margins:

Setting up an API/KSM facility costs anywhere between ₹300–1,000 crore, depending on scale and molecule complexity. Most APIs have thin margins (4–8%), especially in the commodity segment. Because China has already built economies of scale, Indian units find it hard to compete even with incentives.

This is why many Indian firms prefer to import APIs rather than manufacture them unless they are extremely high-margin or critical for in-house formulations. And some other reasons are long gestation periods, where API projects typically have a 3–5-year gestation period. And there are some pharma parks announced in 2020 that are still under construction in 2024, which also led to the missed momentum for the pharma sector.

Conclusion:

India has come a long way in trying to reduce its dependence on imports for key pharma ingredients. Government schemes like PLI, big investments by companies like Dr. Reddy’s, and innovation by startups like Bugworks and String Bio all show that the intent is strong. But despite these efforts, the ground reality is that we still import a majority of our APIs and KSMs, especially from China.

The reasons are clear: high cost of production, strict pollution laws, long project timelines, and low profit margins. Until these core challenges are fixed, companies will find it easier to import than to manufacture in-house.

If India truly wants to become Atmanirbhar in the pharma sector, we need to make manufacturing cleaner, faster, and more profitable. Only then can we truly build a self-reliant healthcare system, one that is not just affordable but also independent and future-ready.

Also Read : The Silent Crisis Behind India’s Pharma Empire