Startup founders have faced a problem over the period due to some regulations, but a recent move by the regulator has become good news for founders.

But before we understand why it is good and how it benefits, first let’s understand what happened

On June 18th, 2025, the Securities and Exchange Board of India took a landmark decision that has allowed startup founders to retain and also exercise their ESOPs granted to them at least one year before filing the Draft Red Herring Prospectus, and even after being classified as promoters.

But if you have no idea about ESOPs, here it is ESOP stands for Employee Stock Option Plan. It is a way for companies to give their employees a chance to own shares (a part of the company) in the future. But instead of giving the shares right away, the company gives the option to buy shares later. ESOPs typically will be given to those who the company thinks will play a key role in building the company.

If you understood what ESOP is, let’s get back to the main point. Why SEBI’s decision is good news for startup founders?

To understand this, let’s set the context

You are a startup founder who built your startup over a period of time. There are some situations where you haven’t taken much of a salary every month just because the company is not stable financially. But instead of taking a high salary, you opted to go for ESOPs.

ESOPs will help you to create wealth in the long run. These were not just compensation; they were your belief in the company’s future.

Now fast forward to the IPO stage. Your company is finally going public. But there is a problem because you are now officially labelled a “promoter,” and you cannot exercise the ESOPs you’ve spent years accumulating. Now what happens to all your sacrifices? It all gets wasted. This is a big loss for the founders. This might seem smaller to you, but what if it might cost some crores? Imagine you are in that position. What will you do? Will you give up on ESOPs? Or will you find any other ways to save those?

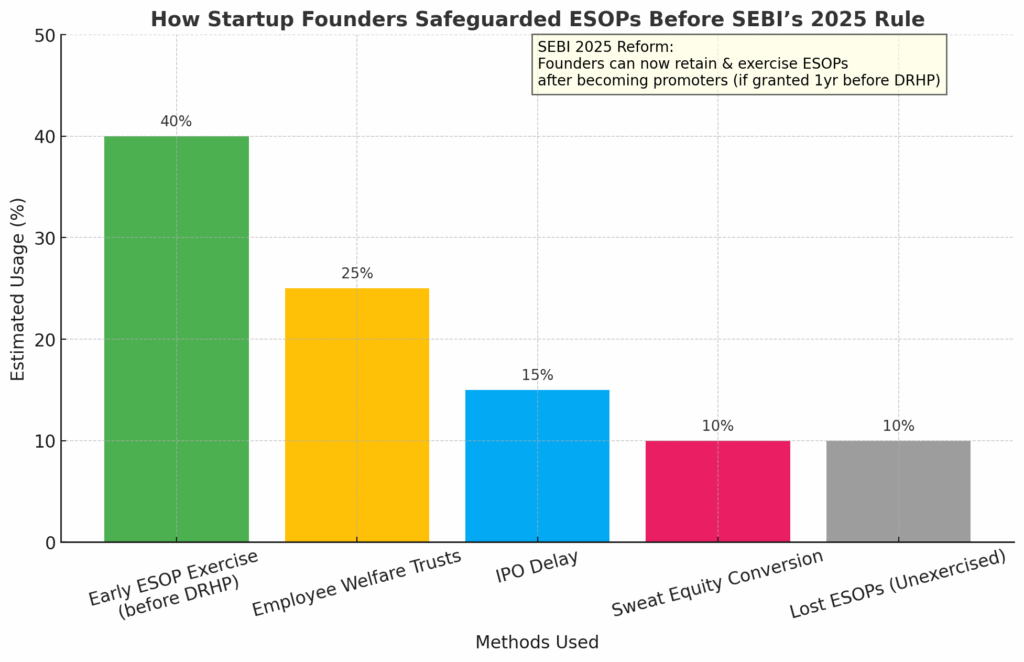

That’s where many companies try to use loopholes or clever techniques to save their ESOPs.

One of the most common practices amongst the startups was to exercise the ESOPs before the DRHP was filed.

The restriction was applied only to unexercised options that are held post-DRHP. So, many founders chose to convert their ESOPs into actual shares before DRHP filing.

While this technically solved the problem, it came with a major problem: taxes had to be paid immediately upon exercising the options, even though the shares couldn’t be sold yet.

Founders had to find the money to pay for both the shares and the taxes, often without any liquidity at hand.

This was the most commonly followed process, but there are even some other aspects that they followed.

One other way that startup founders followed is setting up the employee welfare trusts to hold the ESOPs on behalf of the founders.

In this structure, the shares weren’t directly in the founder’s name, but the trust acted as a custodian. In this way, the founder didn’t own the ESOPs directly, which helped them avoid the SEBI rule.

At first, it looked like a smart solution. But in reality, it was complicated and confusing. It was not always clear who really owned the shares, and these kinds of arrangements often ended up in a legal grey area. SEBI was not okay with this trick, and over time it became obvious that this method wasn’t a reliable or clean way to protect founder ESOPs.

The next way that many founders followed is delaying the IPO so that they will get the time to exercise their ESOPs.

But this comes at a cost of delaying listing, which might even sometimes hurt the business performance because of the need for funds.

Some founders convert their ESOPs into sweat equity shares. For those who don’t know, what is sweat equity?

Sweat equity means getting a share of a company not by paying money, but by working hard for it.

So, there are multiple ways startups and founders tried to follow to save their ESOPs. Now it clearly shows why there is a need for easing the rules.

This law now enables the founders to retain and exercise their ESOPs even if they are classified as promoters, but they should be granted at least one year before the company files for DRHP.

Now founders can keep the equity they earned over the years. They don’t need to find any risky or complicated loopholes in the system to hold and save their ESOPs.

Founders who took small salaries and big risks can finally enjoy this change.

In one simple move, SEBI has reduced the need for legal hacks, protected founder interests, and made the public listing process much cleaner.

For the Indian startup ecosystem, this is more than just regulatory news. It’s a sign that the system is finally listening and evolving.

Also Read: What Is Your Startup Destroying? The Secret Behind True Innovation