What changes have you witnessed since the COVID-19 pandemic? Many people started taking care of their health; they started eating healthy, travelling, and also focusing on fitness. Being fit and eating healthy has really become the obsession of today’s youth. Though this is not a recent phenomenon, this for sure was not the same as how it used to be ten years ago.

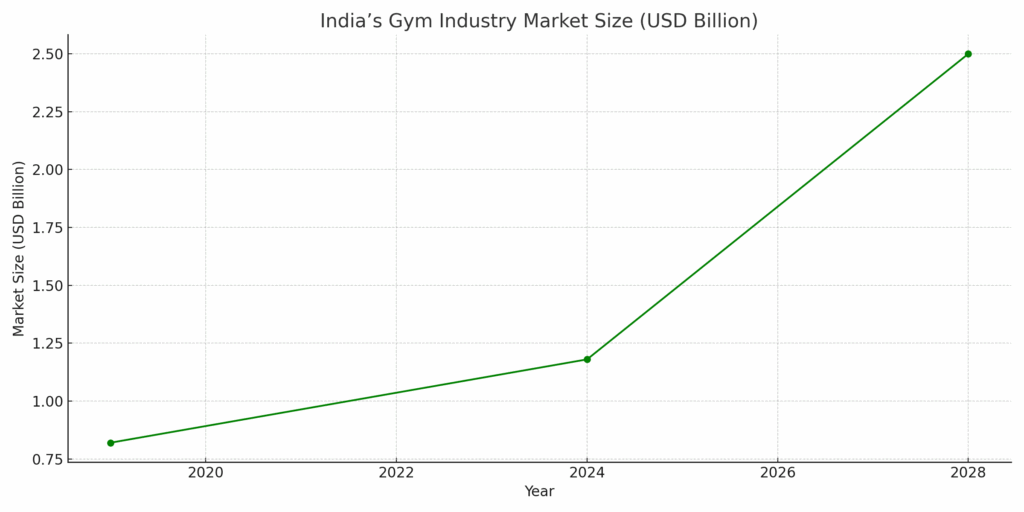

One of the biggest visible shifts? A surge in gym culture. The number of people working out regularly has skyrocketed in recent years, and the numbers prove it. Back in 2019, India’s gym industry generated about $821 million in revenue. Today, that number has grown to around $1.18 billion, with projections suggesting it could cross $2.5 billion by 2028. And yet, here’s the most revealing stat showing gym penetration in India still is at around 0.5%, indicating how much more headroom the industry has to grow.

Now, if we look at the number of gyms in the country, there are around 69,400 gyms. Among them, the organized gyms were just 14%. Meaning still it is not organized well. There are some big players in the gym market, namely Cult Fit, Anytime Fitness, Talwalkar’s, Gold’s Gym, and Snap Fitness. These brands are steadily capturing a larger share of the growing fitness economy in India, transforming what used to be a disjointed industry into a more structured, scalable, and experience-led business.

First, let’s understand the gym industry landscape in India. As of 2023, Cult Fit has the highest number of gyms, which stood at 580, then Talwalkars with 220, Gold’s Gym with 150, Anytime Fitness gyms with 140, and last Snap Fitness with 100 gyms. All the brands have these gyms across the country.

But you know Cult Fit was started a decade ago, and it has quickly gained traction. But how did Cult Fit do it in less than a decade? In this article, let’s delve deeper into it. Let’s start with the founding story. The whole story started when Mukesh Bansal (founder of Myntra) and Ankit Nagori (former Chief Business Officer at Flipkart) joined forces in 2016; they weren’t just building another gym chain. They were trying to solve a much deeper problem: India’s broken relationship with health. Back then, fitness in India was disorganized, uninspiring, and deeply transactional. Gyms were either low-cost and poorly maintained or premium but intimidating. Bansal and Nagori saw this gap and built CureFit (now Cult Fit) to fill it. Their vision was clear: “They don’t want people to just hit the gym. They want them to live healthier, longer, and happier lives all from one integrated platform.”

Cult Fit was never about just physical fitness. From day one, it was designed as a health ecosystem that combined Fitness (Cult.fit) Group classes, strength training, yoga, HRX workouts; Mental wellness (Mind.fit) meditation, therapy sessions; Nutrition (Eat.fit) Healthy meals and diet tracking; Medical care (Care.fit) Online doctor consults, diagnostics, preventive care. And all of it was powered by technology and design.

If we dig into the reasons why Cult.Fit has worked out there are some important points to discuss.

- Integrated Wellness Ecosystem:

Most players offer either fitness, healthcare, or diet plans. Cult Fit combines all three, making it a one-stop solution for health-conscious users. - Brand Partnerships & Celebrity Programs:

Cult.fit partnered with HRX (Hrithik Roshan) and launched exclusive formats that added aspirational value. These programs created a premium perception and helped build brand loyalty. - Tech Integration with Apple Health & Google Fit:

Cult Fit connects directly with popular fitness trackers. This allows users to sync their steps, calories, workouts, and sleep, something most Indian gym chains still can’t offer. - Diversified Revenue Model:

Cult Fit’s success lies in its diversified revenue model beyond just gym memberships. It earns from offline fitness plans and Cult Live, its online workout platform. Through Eat.Fit, it sells healthy meals, while Mind.Fit and Care.Fit adds mental wellness and healthcare services. The brand also sells HRX merchandise, generating high-margin income. Its franchise model enables rapid, asset-light expansion, especially in Tier-2 and Tier-3 cities. Additionally, corporate wellness partnerships provide steady B2B revenue. Together, these streams form a tech-powered health ecosystem that monetizes fitness, food, mind, and care, making Cult Fit a complete lifestyle brand, not just a gym chain.

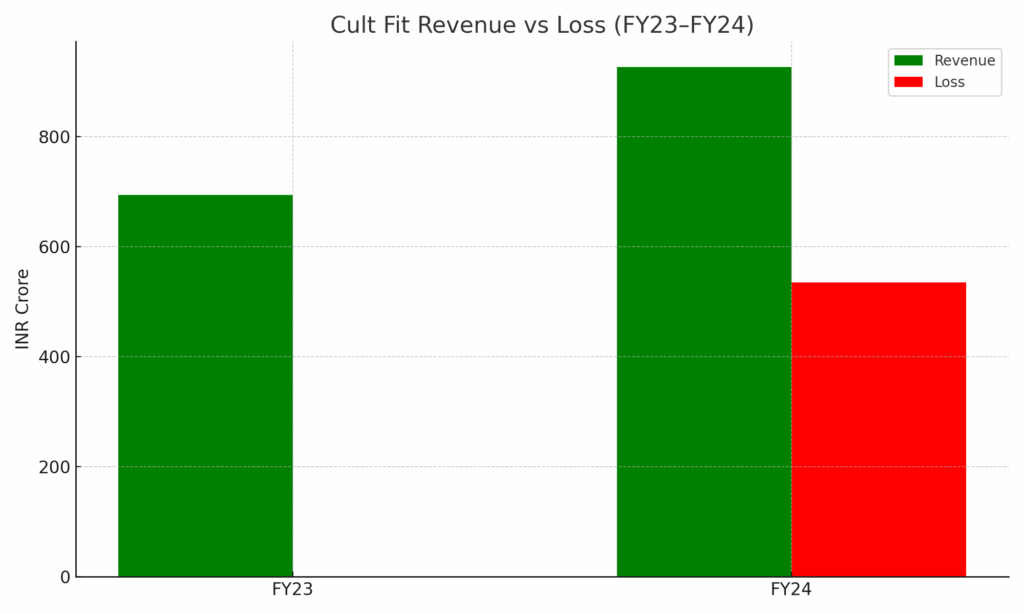

Now, if you understand why Cult is grabbing a major share, let’s dive into their financials as well. As of FY 24, the company has clocked an operating revenue of INR 927 crore, which has increased by 33% from INR 694 crore in FY 23. But the company is making losses as of FY 24, which stood at INR 535 crore. But these losses are accounted for by various reasons that include advertising, operating costs, and material costs.

One of the main challenges in this segment is high operational costs. Cult Fit studios are experience-first spaces with air-conditioned, well-lit, high-end equipment, curated playlists, and trained staff, and they are located in prime urban areas. This comes at a high cost in terms of rent, maintenance, trainer salaries, and tech infrastructure.

The next challenge is with the retention and consistency of users. Most of the people pay for the gyms on January 1st, and most people drop by the end of January, and there are some stats showing 80% of people drop within 5 months. The user acquisition costs are also higher in India, as they need to spend higher amounts, but the retention is hard.

Cult.fit has already seen a huge spike in Tier 1, and though it is not saturated but has reached a peak, it should now focus on expanding to Tier 2 & 3 cities and towns. This will be a game changer, but the survival of the brand in the long run again depends on the financials.

Today, they have hundreds of centers across India and millions using their app. But even now, only a tiny number of Indians go to the gym—less than 1%. This means there’s a huge opportunity ahead, especially in smaller towns and cities where fitness is just beginning to grow. Yes, they have challenges, but they are building something that no one else in India has done at this scale.

If Cult Fit can control its costs, keep users engaged, and grow smartly in new cities, it has the chance to become India’s most trusted health and fitness brand not just for now, but for the future.