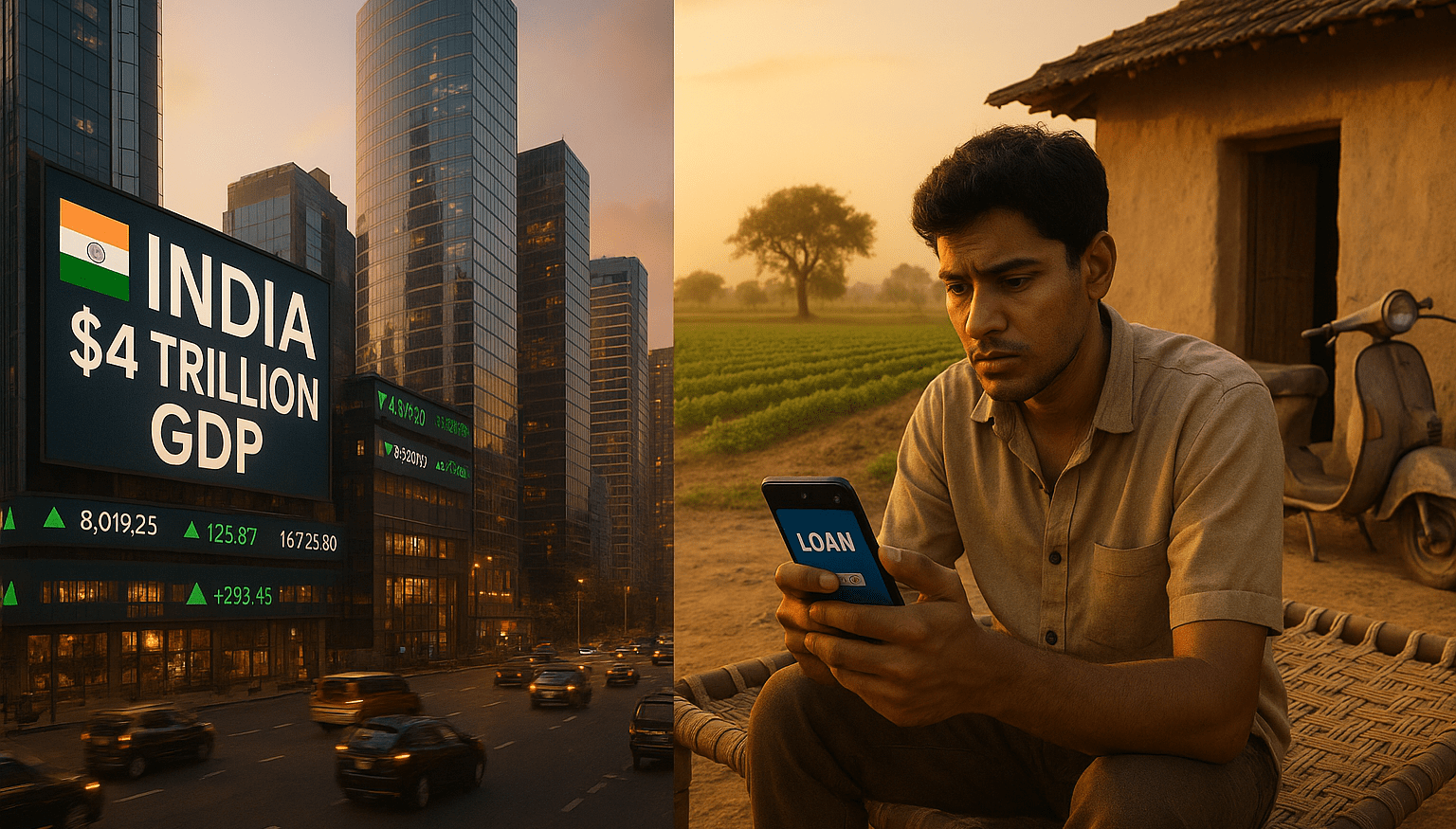

We are now living in a country that has officially become the 4th largest economy in the world, according to IMF projections. With a $4 trillion GDP, India’s rise on the global economic stage is undeniable.

But there’s a catch.

While the country is progressing at scale, its people don’t seem to be moving forward in the same way. When we look at per capita income the amount of money earned per person India still lags behind many countries with much smaller economies.

Take Japan, for example. India recently surpassed it in total GDP, but their per capita income stands at $33,900, while India’s is just $2,880. Japan’s population? 123 million. Ours? A massive 1.46 billion the largest in the world.

This mismatch has sparked debate. Some blame the government, others point to deeper structural issues.

So, what’s really going on here? Why is India rising as a nation but not rising for the average Indian?

Let’s break down four major reasons behind the mismatch between India’s national growth and personal prosperity.

Here it is not focused on income disparities like the rich, middle class, or poor it digs deeper into India’s systemic issues.

1. Sectoral Imbalance in GDP vs Employment

According to the Ministry of Statistics and Programme Implementation (MOSPI), the Indian economy is primarily driven by:

- Services sector: 54% of GDP

- Industrial sector: 31% of GDP

- Agriculture: 15% of GDP

Now, let’s look at the workforce distribution across these sectors:

- Services sector employs 31% of India’s workforce

- Industry employs 23%

- Agriculture employs a massive 46%

Here’s the problem:

- The services sector, though it contributes the most to GDP, doesn’t employ enough people.

- The agriculture sector, on the other hand, employs nearly half the population, but contributes just 15% to the economy.

This means millions of Indians are in low-productivity, low-income jobs, while the booming parts of the economy remain out of reach.

In contrast, countries like China have used manufacturing and investment-led growth to lift incomes. For any nation to grow inclusively, it needs a strong industrial base to create jobs and raise productivity. India’s imbalance here is one of its deepest economic flaws.

2. The Employment Trap

India has a population of over 1.4 billion. Around 960 million people are above age 15, considered the working-age population.

However, only about 578 million people are part of the active workforce.

Let’s break down this workforce:

- 3.2% (18 million) are eligible but not working, due to choice or lack of opportunity.

- 58% (326.5 million) are self-employed. Among them, 33% are unpaid helpers usually in family-run farms or shops.

- 20% (110.7 million) are casual workers in informal, low-wage jobs.

- 13% (70.3 million) are regular salaried workers but without formal contracts.

- Only 9% (51 million) hold formal salaried jobs with benefits like PF, insurance, and job security.

To compare globally:

- Russia: ~85% of jobs are formal

- Brazil: ~68%

- China: ~54%

- Bangladesh: ~42%

- India: just ~9% in formal salaried employment

This shows that the majority of Indians are either underemployed or in insecure, informal jobs. Without strong formal employment, per capita income will always stay low no matter how fast GDP rises.

3. The Skill Deficit Among Youth

India has one of the youngest populations in the world, with a median age of just 28. This should be our biggest strength.

But here’s the reality:

According to the Ministry of Skill Development and Entrepreneurship, 65% of India’s population is under age 35, and a large portion of them lack the skills needed in today’s economy.

We are producing degrees, not employability. Graduates are entering the job market without being job-ready lacking digital, technical, and soft skills.

Industries are struggling to find skilled professionals, while millions of educated youth remain unemployed. This skill mismatch undermines India’s demographic advantage.

4. The Debt Dilemma

One of the most alarming trends in India is the rise in personal debt.

In 2017, personal loans in India totaled ₹1.5 trillion. As of 2024, that number has skyrocketed to ₹9 trillion a 6x increase in just seven years.

What’s more, this rise is driven largely by small-ticket loans (under ₹1 lakh):

- In 2017, small-ticket loans made up 40% of personal lending

- In 2024, they account for 88%

This reflects easy access to digital credit but often without stable income or productive usage.

Reports indicate that some of these loans are being used for high-risk or non-essential consumption, including gambling, online shopping, or lifestyle expenses.

- Household debt as a share of GDP has risen from 33.7% (FY16) to 42% (FY24)

- Meanwhile, household savings have dropped from 22% (2000) to just 18.6% (2024)

We are borrowing more, saving less, and in many cases, spending on non-productive needs.

Fintech credit access is a positive development but only when credit is used wisely. Otherwise, debt traps can hurt both individuals and the economy.

GDP Without Inclusivity Is a Mirage

The problem isn’t just politics or policy it’s systemic. It’s about the gap between education and employability, work and wages, access and awareness.

Until we fix the disconnect between how the Indian economy grows and how its people grow, a $4 trillion GDP is just a shiny number not a shared reality.

Also Read: Arnab Goswami Slams India’s Startup Culture