In today’s Indian startup ecosystem, discussions about profitable Indian startups are often overshadowed as most headlines revolve around funding rounds, customer acquisition, and scale. Words like “growth” and “valuation” dominate pitch decks and boardrooms. However, somewhere along the way, a critical element got sidelined: “profitability.”

For many startups, turning profitable has become a nightmare. Sky-high operating costs and relentless cash burn are troubling many startups and companies in the country. But in this noisy environment, two companies are quietly making profits consistently.

Both of these companies belong to the same founders. One of them has been making headlines for the last four days: “Oxyzo.”

In FY25, Oxyzo reported a profit after tax (PAT) of ₹340 crore on revenues of ₹1,207 crore. Oxyzo has been on a consistent growth path, with PAT figures standing at ₹69.3 crore in FY21, ₹196.5 crore in FY22, and ₹285.7 crore in FY24. But what exactly is this company doing differently to be so consistently profitable?

Oxyzo Financial Services is an RBI-registered Middle Layer NBFC (Non-Banking Financial Company). It provides working capital financing to SMEs and mid-sized corporations and engages in co-lending partnerships.

Think of Oxyzo as a tech-driven lender that helps small and medium enterprises (SMEs) procure raw materials by offering them the necessary capital. It does this in a very focused way; it doesn’t pander to consumers, nor does it diversify unnecessarily. It focuses on credit for industrial raw material procurement.

Remember the line: “Procurement of raw materials.” We will get back here again.

Oxyzo is one company, and there is another company that we need to focus on, “OfBusiness.”

OfBusiness is a B2B commerce platform that provides SMEs with access to industrial raw materials like metals, chemicals, polymers, construction materials, and agri-products.

So, while OfBusiness enables businesses to source raw materials for SMEs, Oxyzo provides the funds to finance those purchases for SMEs.

But what’s the connection?

OfBusiness reportedly holds a 75% stake in Oxyzo. OfBusiness is the parent company, and Oxyzo is the lending arm of OfBusiness.

It’s a deeply integrated business model where one arm supports the operations of the other.

But how do these two companies become so profitable?

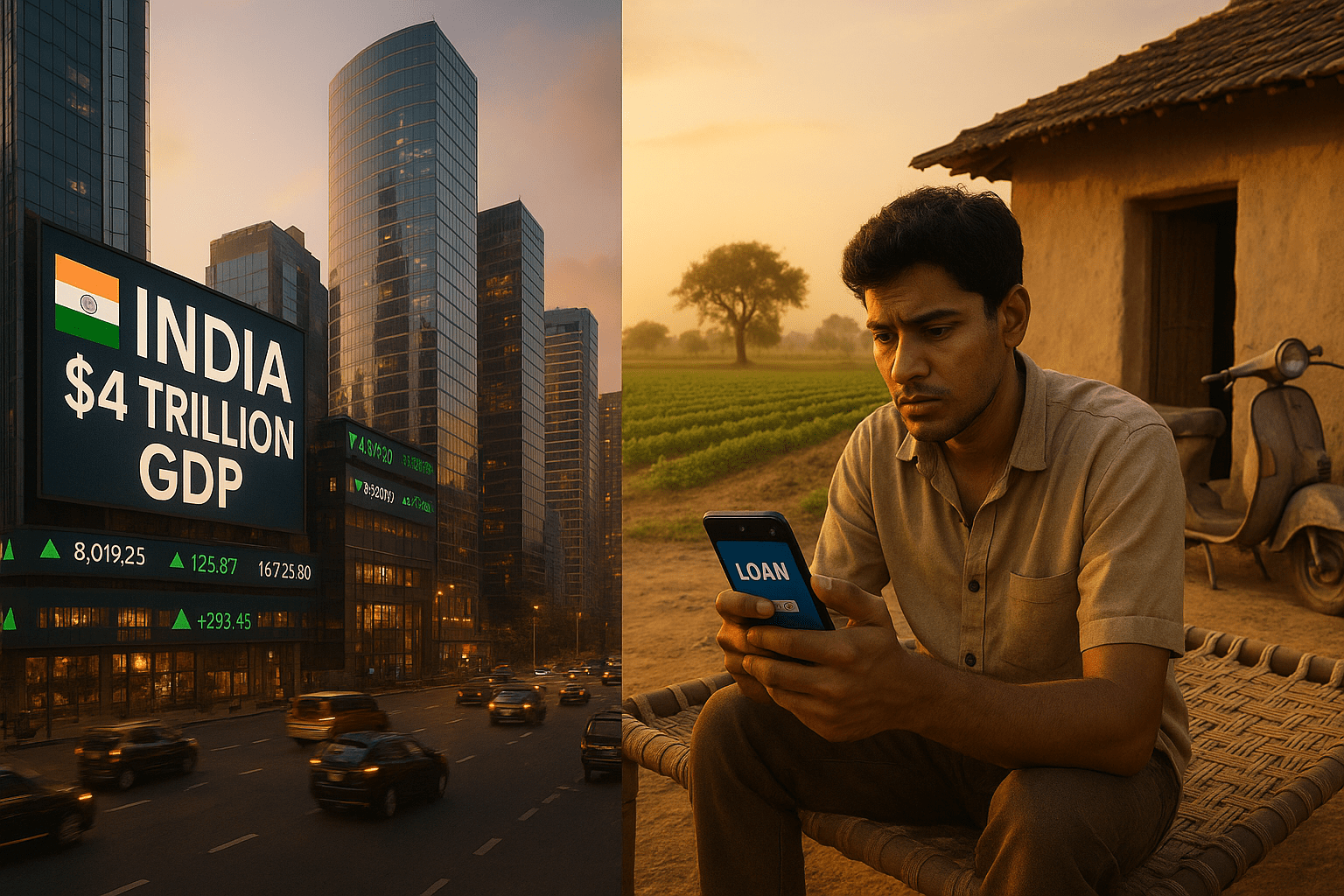

This is where we need to get into the ground realities of doing business in India and why SMEs (small and medium enterprises) are such an important market to focus on.

The SME sector plays a crucial role in India’s socio-economic development. SMEs contribute significantly to the country’s GDP and are one of the largest sources of employment.

According to a Press Information Bureau (PIB) release dated February 4, 2025, the Udyam Portal has over 5.93 crore registered MSMEs, employing more than 25 crore people across the country.

The demand and potential in this segment are massive, which is why even the government has been putting a strong focus on empowering MSMEs.

However, there are two major challenges that still hold this sector back:

- Access to credit, and

- The high cost of raw materials.

Let’s talk about the credit side first. A recent NITI Aayog report (May 2025) highlighted some progress in improving access to formal credit for MSMEs. Between 2020 and 2024, the share of micro and small enterprises getting credit from scheduled banks rose from 14% to almost 20%, and medium enterprises saw their access improve from 4% to around 9%.

Despite the progress, the credit gap is still enormous. As of FY21, only 19% of the total credit demand from MSMEs was being met through formal channels. That leaves a massive gap estimated at around ₹80 lakh crore. This means the majority of MSMEs still depend on informal or expensive sources of funding.

And this is just one side of the story. The other major hurdle is the cost of raw materials, which is significantly inflated in India due to import dependence, high tariffs, and multiple layers of middlemen.

Many of the products manufactured in India aren’t entirely Indian. A large portion of the raw materials, such as chemicals, minerals, or specialized components, are still imported from other countries. These imports are essential because some of these materials are either not available domestically or not available in sufficient quality or quantity.

According to the Hudson Institute, India imposes steep import tariffs on raw materials, capital equipment, and intermediate goods. The average tariff rate in India is 18%, which is significantly higher than countries like Vietnam (9.6%) and China (7.5%). This makes raw materials costlier for Indian manufacturers, affecting their competitiveness in global markets.

Now, if we connect the dots, the picture becomes clearer. There’s a problem with raw material procurement, and there’s a financial gap in being able to fund that procurement.

Solving either of these problems could be a game-changer. Solving both? That’s where these two companies get the edge.

Now, let’s take a closer look at Oxyzo, a company that has recently been making headlines.

In FY 2025, Oxyzo reported a Profit After Tax (PAT) of ₹340 crore, marking a 16.5% growth from the previous year’s ₹285 crore. Its revenues also jumped by 33%, rising from ₹903 crore in FY 2024 to ₹1,207 crore in FY 2025.

When we break down the expenses, the picture becomes even more interesting. Out of every ₹100 the company earns, about 58% goes towards finance costs, which includes the interest they pay on borrowed capital. Employee benefits take up 19%, and the remaining 23% covers administrative, legal, and other operational costs.

Altogether, Oxyzo’s total expenses stood at around ₹755 crore. So out of the overall revenue, this forms a major chunk, but the margins are quite good, which allows them to maintain strong profitability and growth.

While revenue growth and profitability grab headlines, asset quality is what separates a smart lender from a risky one. And this is where Oxyzo quietly outperforms most of its fintech peers and even traditional NBFCs.

Though the FY25 complete data is not yet released, as of FY24, gross NPA is 1.02% and net NPA is 0.46%.

For those who didn’t understand what NPA is? It stands for non-performing assets, meaning it refers to a loan or advance that has become overdue for a certain period, typically 90 days or more, and is at risk of not being repaid.

So, NPA should be lesser. To put it in perspective, many NBFCs in India operate with GNPAs between 3–6%. For a rapidly growing company like Oxyzo to maintain <1.1% GNPA is a sign of superior underwriting, disciplined disbursal, and tight collection mechanisms.

But how is it keeping it low?

Unlike other digital lenders focusing heavily on unsecured credit, Oxyzo leans into secured working capital loans tied to real industrial transactions. This drastically reduces default risk and ensures collateral-backed recoveries in case of delinquencies.

OfBusiness gives Oxyzo real-time data on SME behavior like purchase cycles, material usage, and credit patterns, allowing it to underwrite risk better than banks. Borrowers aren’t just random leads; they are already transacting on the OfBusiness platform.

If you zoom out and look at the bigger picture, what you’ll see is a well-integrated ecosystem between Oxyzo and OfBusiness.

However, there’s another side to consider, which is concentration risk. Since Oxyzo’s business is largely built on top of OfBusiness, its performance is closely tied to the performance and direction of OfBusiness. Any potential disruption in OfBusiness could directly impact Oxyzo’s growth and operations.

As per several reports, OfBusiness is expected to go public this year, which will be a key event to watch.

To sum it all up, if you’re a business enthusiast with big ambitions, here are a few key takeaways:

- Scaling and customer acquisition are critical, but always keep an eye on profitability, because that’s what sustains a business in the long run.

- Focus on building a business with depth, one that understands its industry and integrates operations smartly. That’s how you create massive value, not just for yourself but for your team, your shareholders, and the market at large.

Also Read: India Startup Funding 2025 Surges to $3.1B as AI and Deeptech Attract VC Attention