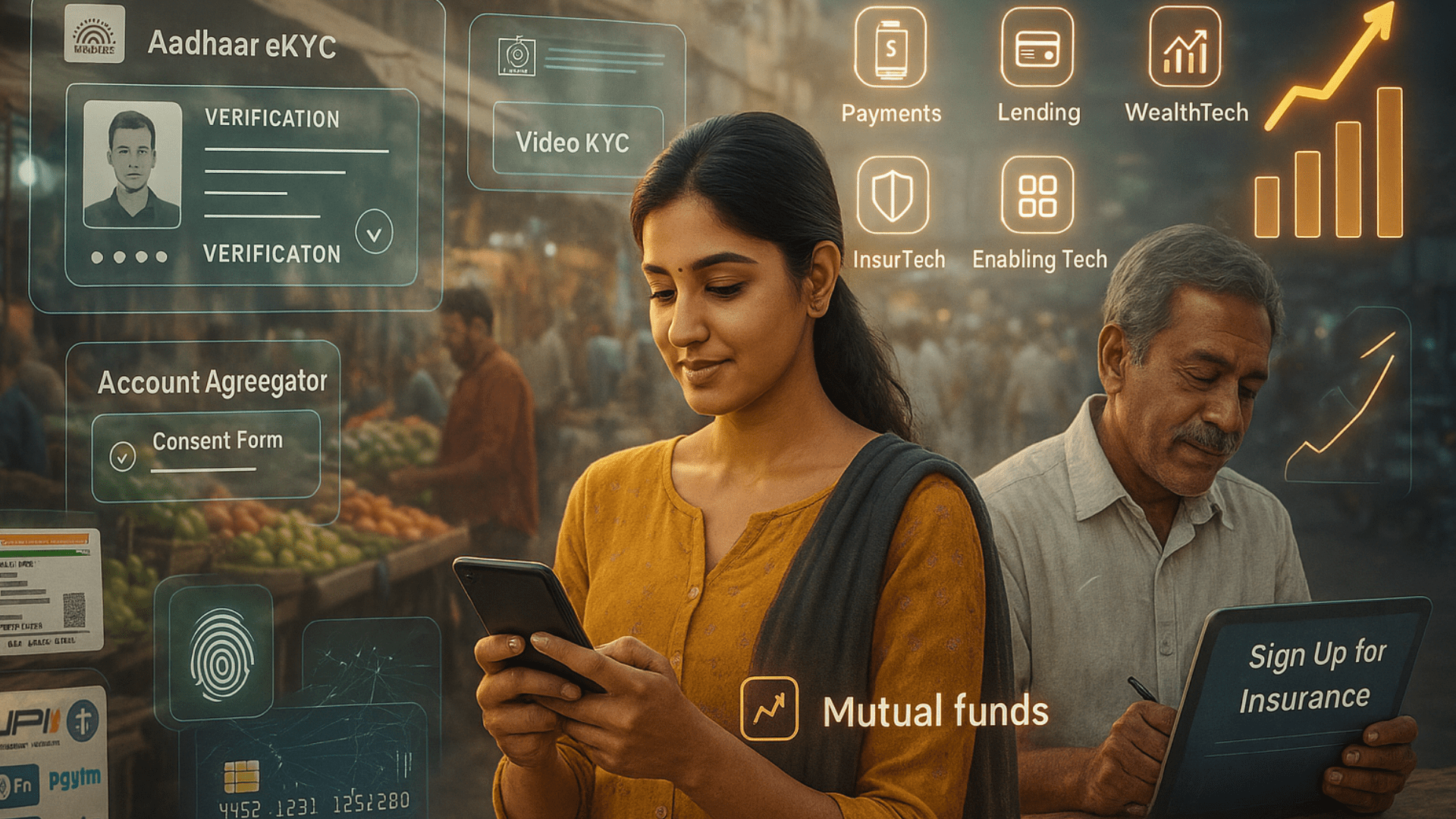

The Indian fintech sector has always taken center stage in the startup ecosystem. With over 29 fintech unicorns, it continues to lead the charge in innovation, investment, and impact. But fintech is a vast space with five key segments: lending, payments, wealth tech, insurtech, and enabling tech.

In Part 1 of this series, we explored the lending segment, which has attracted the major share of funding and attention. We discussed why lending startups have grown rapidly.

If you haven’t read that yet, we recommend checking it out first before diving into this second part.

Now, let’s go back to the bigger question that sparked this series:

Why is the fintech revolution happening now and not 10, 20, or 30 years ago? And why do investors continue to bet big on this space?

Setting the Context with Numbers

Let’s begin by looking at the payments segment, which has seen some of the highest capital inflows in recent years. In 2023 alone, the segment attracted USD 919 million in total funding. Out of this, PhonePe alone raised around USD 850 million, making it the top-funded fintech of the year.

Other major players like CRED, Pine Labs, NiYo, and OneCard also secured funding of over USD 100 million each in 2022.

If we break it down further within the payments ecosystem:

- Payment Service Providers (PSPs) accounted for 47% of the total funding in FY22.

- Co-branded card startups followed with 24%.

- And point-of-sale (POS) providers contributed 13%.

Among the 29 fintech unicorns in India, 9 belong to this payment-focused category.

Zooming Into Other Key Segments

Let’s now take a quick look at the other important parts of fintech, such as WealthTech and InsurTech.

Starting with WealthTech:

- In 2022, this segment raised over USD 380 million, but in 2023, that figure dropped sharply to USD 39 million.

- Within WealthTech, Personal Finance Management (PFM) led the way, accounting for 61% of the 2022 funding, followed by Broking & Trading (13%) and Alternative Investments (9%).

Startups like INDmoney and Jar are notable players in this space, trying to bring investing habits to the masses.

Moving to InsurTech, The segment raised around USD 322 million in recent years, outpacing WealthTech in capital raises.

Players in this space fall into three broad types: insurance intermediaries, insurance manufacturers, and insurance platform providers.

So Why Now? What’s Fueling the Fintech Surge?

The numbers are impressive, but there’s always a deeper reason behind them. Let’s start with insurance, where the gaps are massive and the opportunities even bigger.

Despite a growing middle class, insurance penetration in India remains significantly below global standards.

- According to reports, India has a life insurance protection gap of 87%.

- Among people aged 26–35, the mortality protection gap crosses 90%.

- In health insurance, the gap is around 73%.

What does this mean in simple terms?

It means more than half of India’s population still doesn’t have any form of insurance coverage. That is not just a gap but a multi-billion-dollar problem waiting to be solved.

And the WealthTech space is similar. Data shows that only about 3% of Indians actively invest. This low participation is shaped by many factors, like lack of awareness, low trust in financial systems, and prior bad experiences being the key ones.

So, whether it’s insurance or investing, these sectors are thriving today because they’re finally solving deep-rooted problems that have existed for decades.

And growing digital experiences and hassle-free transactions are boosting the usage of online payments.

So, we understood growth and the gaps, but there are some key reasons that have shaped today’s fintech as it is.

Any guess what has changed the whole face of fintech? You all know the answer; maybe it’s not hitting the point for you.

Aadhaar. Yes, Aadhaar is the one that has started to reshape the overall fintech. But why Aadhaar? Aadhaar today connects over 1.3 billion Indians. But Aadhaar is not just an ID; it’s a digital infrastructure layer that unlocked access, scale, and trust. Before Aadhaar, verifying a person’s identity in India was a hectic process that required piles of paperwork, multiple visits, and weeks of waiting. Aadhaar changed that; it brought in the ability to instantly verify identity, even for those who were previously unbanked, undocumented, or digitally excluded. Fintech startups could now reach deep into Tier 2, Tier 3, and rural India with ease. This meant faster onboarding, better compliance, and more people being pulled into the formal financial ecosystem.

Now comes the real magic: KYC – Know Your Customer. Traditionally, KYC used to be one of the biggest problems for any financial service provider. It was manual, time-consuming, and expensive. But with Aadhaar-enabled eKYC and video KYC, this step became faster.

What used to take days or even weeks can now happen in 30 seconds.

And for users, it was finally finance at their fingertips with no documents, no delays, and no middlemen.

The latest and perhaps the most transformative layer is the Account Aggregator (AA) framework. They allow individuals to securely share their financial information (bank statements, insurance, tax data, etc.) with service providers in real time and with full consent.

For lenders, this means more accurate risk assessment and faster credit decisions. For users, it means personalized financial products with better pricing and transparency.

Account aggregators are fundamentally reshaping how trust, access, and privacy are handled in financial services.

All of these were developed during the last decade. Aadhaar, though, started over 15 years ago its full potential has come into the picture in the last decade.

So, when we understood that there is a huge gap in the system and also that there are enough developed systems like Aadhaar, KYC, and account aggregators, we had some crazy minds working to solve the gaps in the finance ecosystem.

What was lacking earlier? Capital.

Let me ask you a question: Now, if you have your money with you and someone approached you to pitch an idea that solves real problems in India which has growth potential and a humongous untapped segment will you invest or not?

You will, right? That’s what’s happening in the Indian fintech ecosystem. Indian startups are building tech solutions that are solving the major problems in the finance domain, such as insurance, wealth, lending, and payments.

The infrastructure is ready, and capital is flowing, boosting the ideas that are resulting in the fintech boom.

So the real question is: How far can we go when technology meets trust at scale?

Also Read: Why Fintech Is Dominating Startup Funding in India