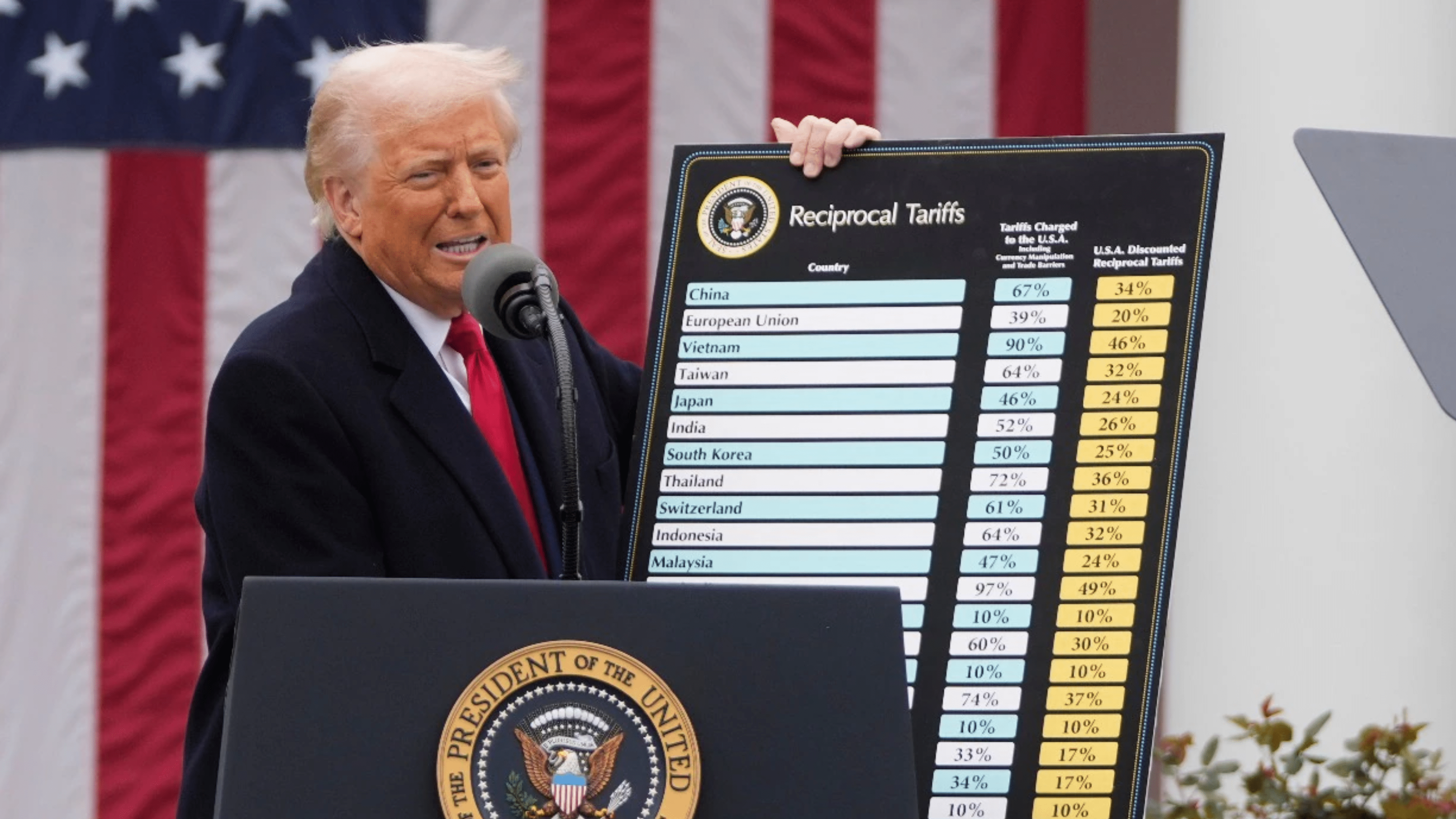

Trump’s 26% tariffs on India have come into effect from April 9, 2025, triggering fresh tensions between the two nations and shaking up key sectors of India’s economy. Announced as a reciprocal move to address the $46 billion U.S. trade deficit with India, the decision is already impacting exports, markets, and startup momentum. Here’s a fact-checked breakdown of what these tariffs mean for India’s economy, businesses, and global position. White House Reports on the Trump 26% tariffs on India.

Indian export impact Trump tariffs

India’s export revenue is projected to dip by 3–3.5% due to the tariffs, according to SBI Research. However, analysts highlight India’s resilience due to:

- Diversified export markets: Only 18% of India’s goods exports go to the U.S.A, reducing overreliance.

- Domestic demand: Strong internal consumption cushions external shocks.

- Trade route innovations: New Europe-Middle East-U.S. corridors could bypass traditional bottlenecks.

Fact Check: While some reports initially cited a 27% tariff, official White House documents confirm 26%. Claims of “currency manipulation” by India remain unverified but are cited as a rationale for the Trump 26% tariffs on India.

Stock Market: IT Plummets, Pharma Surges Amid Tariff Dichotomy

The Trump 26% tariffs on India triggered a sectoral split in Indian markets:

- IT stocks (Nifty IT Index: -4%): Fears of future tariffs on IT services spooked investors, despite no immediate levies. TCS and Infosys led declines.

- Pharma stocks (Nifty Pharma Index: +3%): Excluded from tariffs, companies like Sun Pharma rallied on renewed U.S. export optimism.

- Broader market stability: Sensex fell marginally (-0.3%), showcasing India’s insulated equity ecosystem.

Fact Check: Contrary to early warnings, pharma escaped direct tariffs, explaining the rally. IT’s drop reflects anticipatory risk, not current policy.

Sectoral Breakdown: Auto, Textiles, and Gems at Ground Zero

Automobiles

- Impact: Tata Motors (-5%), Sona Comstar (-4%) due to cumulative 51% tariffs on auto parts resulting from the Trump 26% tariffs on India.

- Mitigation: India may cut tariffs on $23 billion of U.S. imports, including auto components.

Textiles and Gems

- High risk: Low-margin sectors face pricing challenges. Lesotho (50% tariff) and Bangladesh (37%) face steeper rates, offering India relative competitiveness despite Trump 26% tariffs on India.

Engineering Goods and Electronics

- Supply chain shifts: Manufacturers may relocate to ASEAN nations to avoid U.S. duties.

Startups and Small Businesses: Funding Winter Intensifies

- Export-focused startups in SaaS, handicrafts, and textiles face reduced U.S. market access due to Trump 26% tariffs on India.

- Import-dependent ventures (e.g., electronics assemblers) grapple with costlier components.

- Silver lining: Cheaper Chinese manufacturing alternatives could emerge as China faces higher 34% U.S. tariffs.

Banking and Inflation: Limited Direct Risks

- Banking sector: Exposure to SMEs in vulnerable sectors may spike NPAs, but systemic risk remains low.

- Inflation: Minimal impact expected as India’s consumer basket relies less on U.S. imports.

- India is fast-tracking a trade pact with the U.S., offering concessions like:

- Reduced duties on bourbon, Harley-Davidson bikes.

- Increased LNG and defense purchases.

- Dismantling non-tariff barriers to unlock $5.3B/year in U.S. exports.

Conclusion: Storm Clouds With Silver Linings

While Trump’s tariffs disrupt short-term trade, India’s economic agility—domestic demand, export diversification, and strategic deals—positions it to weather the storm. For investors, pharma and domestic-consumption stocks offer safe havens, while IT remains a high-risk, high-reward bet. The ultimate truth? Despite the Trump 26% tariffs on India, the country’s growth story, poised to make it the world’s third-largest economy, remains intact.

Also Read : The Real Debate: Are Indian Startups Stuck in Delivery, or Laying the Groundwork for the Future?