There was a time when electric vehicles (EVs) were a niche dream of the eco-conscious elite. Today, they are at the heart of a geopolitical race, industrial revolutions, and climate ambitions that go far beyond zero-emission tailpipes. So, what’s really driving the global EV boom clean air or global control?

The EV boom: where do we stand in 2025?

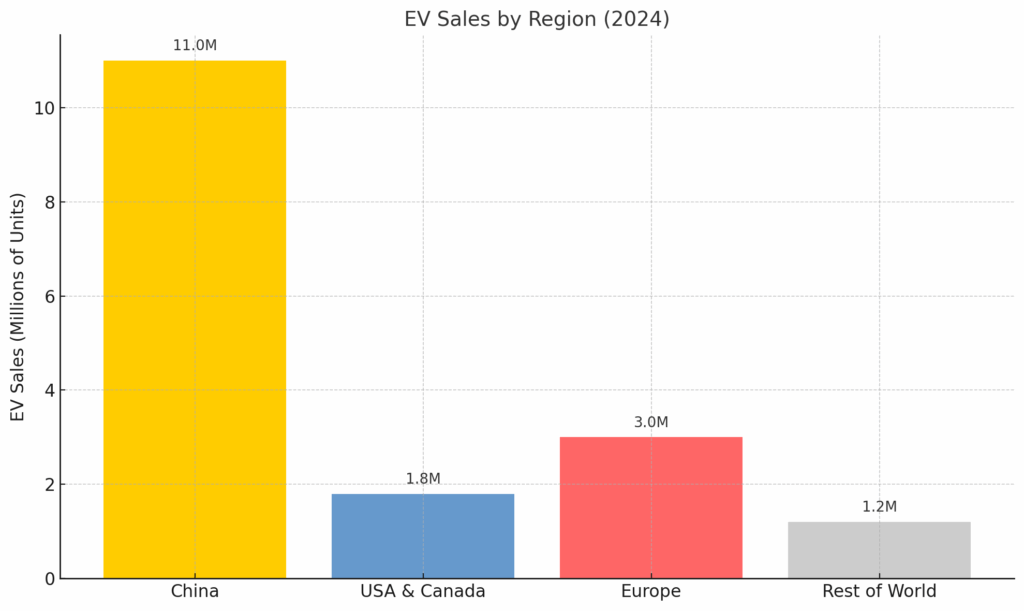

Electric vehiclesbattery electric (BEV) and plug-in hybrids (PHEV) have moved from margins to mainstream. In 2024 alone, global EV sales surpassed 17 million units, with projections for 2025 exceeding 20 million. Fully electric models accounted for about 25% of all new cars sold globally, with growth strongest in China, Europe, and the U.S.

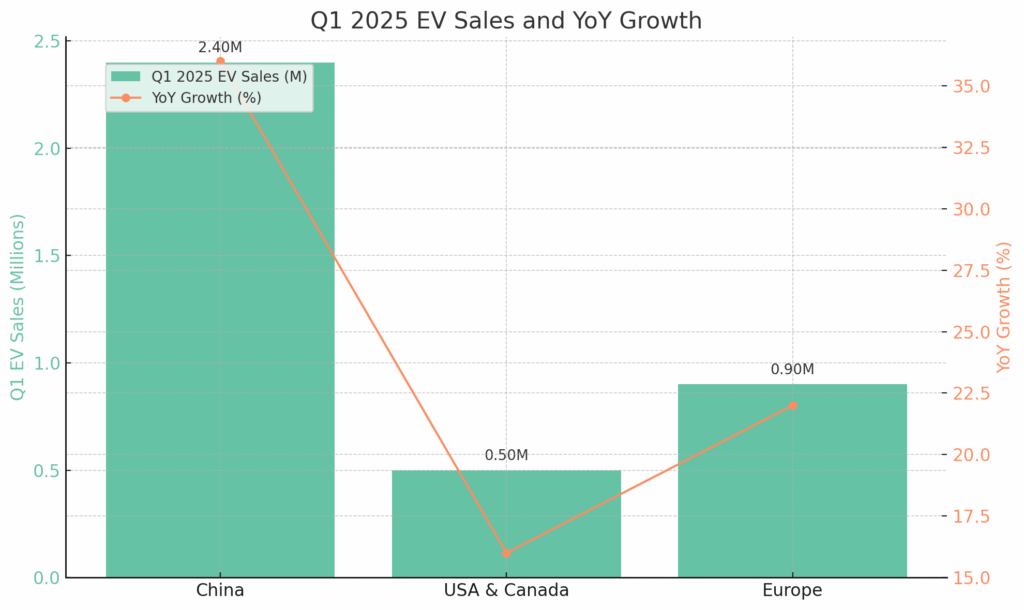

China continues to dominate the global EV market, selling ~11 million units in 2024 (a 40% YoY growth). In May 2025 alone, it recorded a staggering 1.02 million EVs sold in a single month. The country’s EV market share is estimated at ~45% in 2024, projected to hit 80% by 2030.

Europe sold ~3 million EVs in 2024 (a -3% decline), but rebounded in early 2025 with Q1 sales up 22% YoY and May 2025 sales up 36% YoY to 0.33 million units. The region’s EV market share stands around 25%.

The U.S. and Canada sold ~1.8 million EVs in 2024, marking a 9% increase YoY, with Q1 2025 sales at 0.5 million units (+16% YoY). States like California are leading the charge, surpassing 25% market share.

India, while still a small player in passenger EVs (only ~2.5% market share in 2024), is growing rapidly, especially in two- and three-wheelers. S&P Global projects a 140% rise in BEV production in 2025, reaching ~300,000 units.

What’s fueling the transition?

EVs were once hailed purely for their environmental benefitscutting emissions, reducing pollution, and breaking oil dependence. But today, the race to dominate the EV space is more than just about clean air. It’s about technological supremacy, industrial leverage, and securing critical supply chains.

Governments now treat EVs as strategic assets. From the U.S.’s $370 billion clean energy push under the Inflation Reduction Act to the EU’s strict CO2 cut targets and China’s massive subsidies and cheap credit for EV makers, every major power is all-in.

Who’s leading and who’s catching up?

China isn’t just ahead; it’s setting the pace. It manufactured 9.3 million EVs in 2023 and exported around 900,000half of them from Western brands using Chinese facilities. Local giants like BYD sold nearly 3 million vehicles in 2023, overtaking Tesla. Backed by extensive R&D and government support, Chinese firms are building gigafactories in Europe and the U.S., expanding their global influence.

Europe follows closely, but with dependencies. While it has passed major regulations and poured billions into electrification, it still relies heavily on China for battery materials and processing. VW Group, Mercedes-Benz, and BMW have ramped up their EV output, but the region’s raw material supply remains a weak spot.

The U.S. is scaling up fastTesla still holds ~50% of the U.S. EV market. The government’s policies offer generous incentives for domestically assembled EVs with locally sourced components. But adoption remains slower compared to China and Europe, partly due to consumer habits favoring larger gas-powered trucks.

Japan and South Korea, traditionally strong in automotive tech, lag in EV adoption but are catching up with battery development. India, meanwhile, is an emerging contender.

What Powers an EV and who controls it?

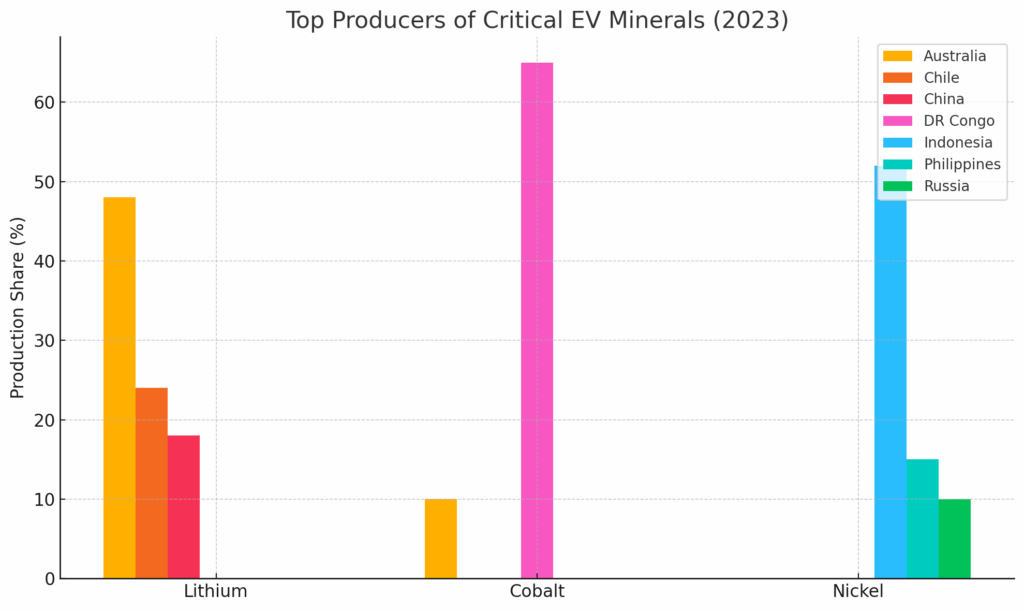

EVs require giant batteriesand batteries need lithium, cobalt, and nickel. But these minerals come from a handful of nations:

- Lithium: Australia (48%), Chile (24%), China (18%)

- Cobalt: DR Congo (60–70%)

- Nickel: Indonesia (>50%)

These concentrated supply chains are a double-edged sword. On one hand, they allow nations like China to dominate EV battery productionprocessing 68% of global cobalt and 72% of lithium in 2022. On the other, they expose the world to price shocks and geopolitical risk.

China has smartly secured control over these resourcesinvesting $5.6 billion in foreign lithium assets and banning raw ore exports to build its domestic supply chain. Western nations are now scrambling. The U.S. ties EV subsidies to sourcing from North America or allied nations. The EU is funding battery plants under its Critical Raw Materials Act. But catching up won’t be easy.

The flip side: Environmental Trade-offs

EVs are far cleaner than petrol cars over their lifetimeBEVs emit 30–40% less CO2 in major markets. As grids get greener, this difference will widen. Yet, the transition isn’t impact-free. Mining lithium, cobalt, and nickel can damage ecosystems and involve exploitative labor practicesespecially in the DRC and Indonesia.

The push to electrify, therefore, shifts the burdenfrom tailpipes to mines. Sustainable extraction and clean battery manufacturing must become part of the EV agenda to avoid trading one crisis for another.

India’s EV Story: Ambition vs. Reality

India wants 30% of new passenger car sales to be electric by 2030. Programs like FAME and PLI offer subsidies for vehicles and local manufacturing. The government also cut EV import tariffs and expanded duty exemptions for battery components.

Still, India’s EV penetration remains lowjust 2.5% of passenger car sales in 2024. High prices, uneven charging infrastructure, and a coal-heavy power grid all pose challenges. Yet, signs of momentum are visible. S&P Global expects a 140% jump in BEV production in 2025, reaching around 300,000 units. Tata, Mahindra, Maruti, and Hyundai are launching new EV models. And in two- and three-wheelers, India is electrifying fast.

If India can build domestic battery capacity and cleaner power grids, it could emerge as a global EV hub.

Fuel vs. Future: will ICE survive the shift?

Internal combustion engine (ICE) vehicles are not dead yet. In fact, they still dominate most global markets, especially in developing countries. But the cost dynamics are changing fast. EVs cost more upfront but save on fuel and maintenancesometimes 40–60% cheaper over a lifetime.

In China, 60% of EV models are already cheaper than their petrol counterparts. As battery prices fall and incentives rise, price parity will spread to Europe, the U.S., and beyond. Meanwhile, hydrogen fuel-cell vehicles (FCEVs) may find niche roles in trucks and heavy transport but remain far from mainstream due to high costs and infrastructure needs.

So, what’s the real motive?

Is the world switching to EVs just to save the planet? That’s only part of the story.

EVs are now strategic assets. They’re about climatebut also about control. Controlling the mines, the gigafactories, the battery techthat’s the real prize. Whoever commands the EV value chain will command the automotive future, and possibly the energy economy.

For countries like China, EVs are a statement of industrial dominance. For the West, they’re a bid to catch up, reclaim supply chains, and cut oil dependence. For India, they are a chance to leapfrog.

The road ahead is electric but also political

The EV shift is undeniable. The numbers show explosive adoption, heavy investments, and a rewriting of the automotive rulebook. But the motivations are layered: environmental urgency, economic opportunity, and geopolitical muscle.

If the 20th century was won on oil, the 21st might be won on batteries.

So yes, electric cars may help save the Climate crisis. But make no mistake they’re also redrawing the map of global power.

Also Read: SEBI’s 2025 Game-Changing ESOP Rule for Indian Startup Founders