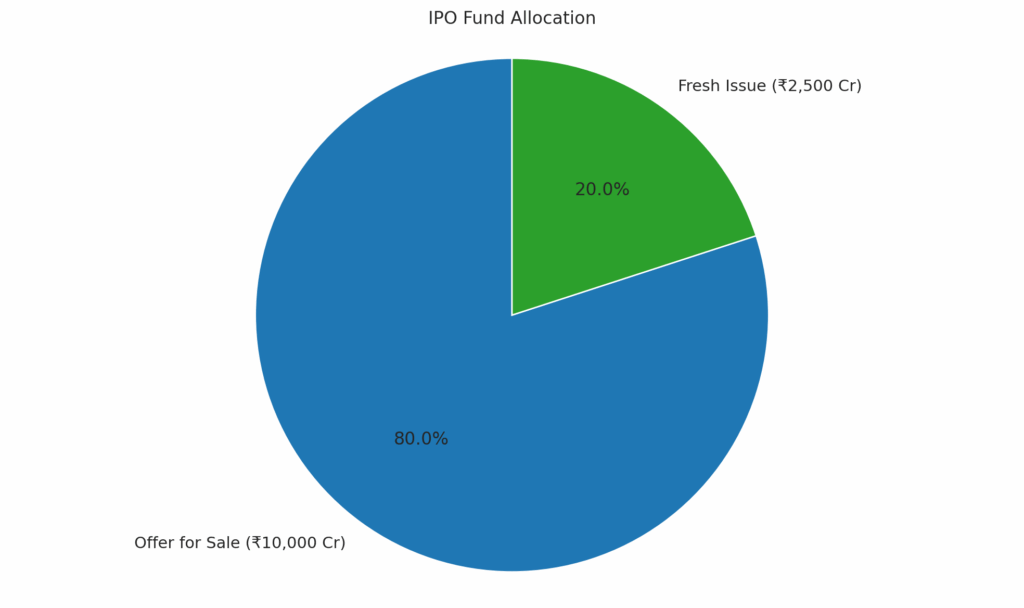

For over a decade, HDB Financial Services has remained silent and no one not talked about it. It was profitable, big enough to make headlines but no noise at all. While the stock market has celebrated startups with sky-high valuations and almost zero profits, this company quietly built an empire in the NBFC segment. It turned profitable every single year, and it has become one of India’s credit engines. Why are we talking about this today? As we all know, HDB Financial Services IPO window opens today. People can apply for its IPO starting today. But before we apply for the IPO, let’s understand HDB Financial Services. HDB Financials Services is one of the leading, diversified, and retail-focused non-banking financial companies (NBFCs). HDB Financials is categorized as an upper-layer NBFC by the RBI. HDB Financial Services is planning to raise INR 12,500 crore through its IPO, which makes the company the largest public issue in India’s NBFC segment. Out of this INR 12,500 crore, OFS is the major portion, contributing INR 10,000 crore, and the remaining INR 2,500 crore is a fresh issue that is going to be used for capital requirements and to boost lending growth. But there’s one more strong reason why this IPO is happening now. Let’s understand this clearly first: In October 2021, the Reserve Bank of India (RBI) introduced a Scale-Based Regulatory (SBR) Framework to strengthen supervision over NBFCs based on their size, complexity, and systemic risk. Under this framework, NBFCs are categorized into four layers: Base Layer (BL), Middle Layer (ML), Upper Layer (UL), and Top Layer (TL).

Why NBFC–UL Matters

The Upper Layer is for NBFCs that are large and important enough to pose systemic risk to the economy, even if they are not banks. These are typically NBFCs with assets over ₹50,000 crore and chosen by the RBI based on complexity, interconnectedness, leverage, etc. Being placed in the UL means the company will be subjected to bank-like regulations, such as mandatory core banking solutions (CBS), board composition requirements, more disclosures, stricter governance, and mandatory listing (IPO) if not already listed within 3 years.

RBI’s Deadline: Why September 2025 Matters

In September 2022, the RBI formally listed 16 NBFCs in the Upper Layer, including HDB Financial Services, and as per the SBR framework, all NBFC–ULs must be listed on the stock exchanges within 3 years of being classified. HDB Financial was classified as NBFC–UL in September 2022, which means the IPO must be completed by September 2025. That’s why this IPO is not just strategic; it is regulatory.

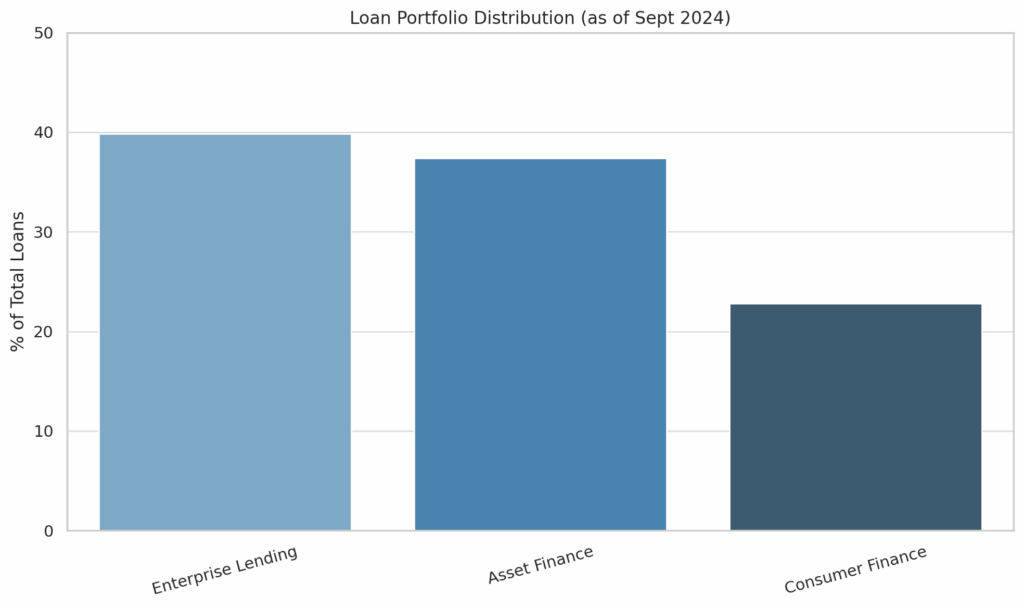

If it is clear why this IPO is happening now, let’s move on to the business of the company. The company’s loan portfolio spans three key verticals, each designed to cater to specific customer needs:

• Enterprise Lending (39.85% of total gross loans): This vertical focuses on serving micro, small, and medium enterprises (MSMEs) through both secured and unsecured loans, helping them meet their evolving business requirements.

• Asset Finance (37.36%): This segment provides secured loans for income-generating assets like new and used commercial vehicles, construction equipment, and tractors, empowering customers to invest in productivity.

• Consumer Finance (22.79%): Here, HDB offers loans (both secured and unsecured) for consumer durables, lifestyle products, two-wheelers, automobiles, and personal loans, supporting individual aspirations and everyday needs.

As of September 30, 2024, secured loans comprised 71.08% of the total gross loan book, while unsecured loans accounted for the remaining 28.92%. Beyond lending, HDB also extends business process outsourcing (BPO) services such as back-office operations, collections, and sales support, primarily to its promoter, HDFC Bank. Additionally, it offers fee-based services like insurance distribution to its lending customers, creating diversified revenue streams beyond interest income.

Coming to the core strengths of the HDB Financial Services has the support of its parent company, HDFC Bank. This backing gives the company strong brand credibility, equity, and also the ability for the company to get low cost funding. But why low-cost funding? Unlike regular banks, HDB Financial Services, being an NBFC, cannot take deposits from the public. This usually forces NBFCs to borrow money at higher interest rates. But HDB has a big advantage as it’s backed by HDFC Bank. Because of this, HDB can get funds more easily and at lower interest rates, borrow at better terms due to HDFC Bank’s strong credit profile, and maintain a healthy profit margin on its loans. This close link with HDFC Bank gives HDB a major edge over other NBFCs that don’t have such strong parent support.

Secondly, if we look at the bank’s loan book, it is so granular, which is a positive for the HDB. The company targets underbanked and first-time borrowers and serves over 5 million customers, and they also manage a balanced mix of loans, and no product contributes more than 25% of the loan book. Which helps the banks to manage the money and enhance the resilience across the loan cycles.

A third important strength lies with the HDB’s presence; it has almost 80% of its branches in rural areas and outside the top 20 cities. It benefits the bank in the long run when there is rural credit growth. It has around 1772 branches and almost 140,000+ dealer touchpoints, which makes the distribution easier and increases the omnichannel experience.

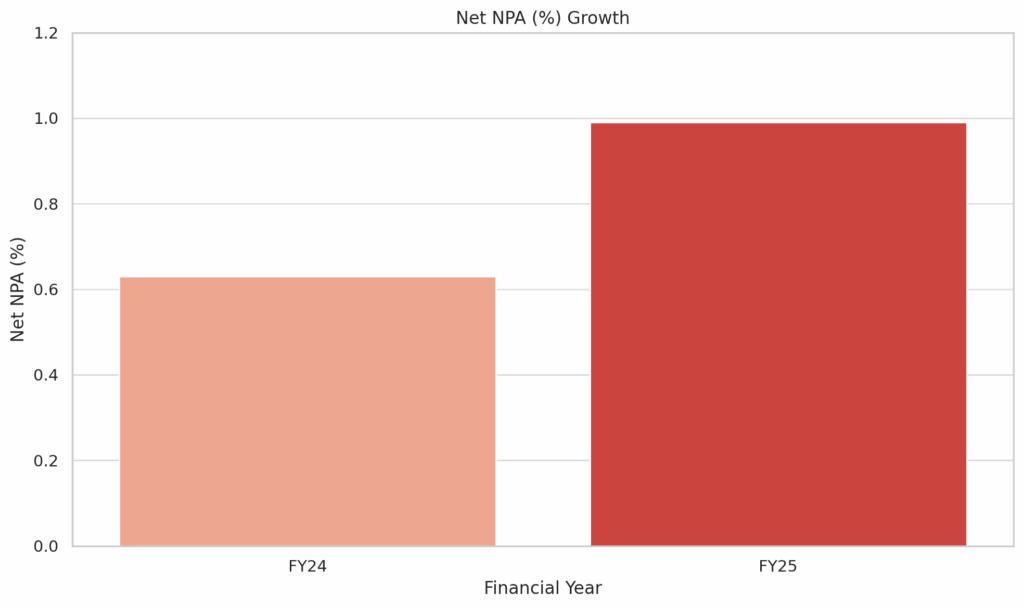

But coming to risks, the major risk is with the competition. There is a huge competition in this space because of Bajaj Finance and Sundaram Finance. HDB Financial Services’ revenue increased to ₹16,300 crore in FY25, compared to ₹14,171 crore in FY24, showing good growth. Its net NPA (non-performing assets) has slightly gone up. It was 0.63% in FY24 and now stands at 0.99% in FY25. This means there’s a small rise in bad loans. Return on Equity (ROE) has dropped over the last few years. It was 18.68% in FY23, improved to 19.55% in FY24, but then dropped to 14.72% in FY25. Even the Profit After Tax (PAT) has come down; it now stands at ₹2,176 crore in FY25, which is lower than the previous year. The company’s Net Interest Margin (NIM), which shows how much profit it makes on lending, has also slightly decreased. NIM now stands at 7.5%.

The IPO opens today, aiming to raise ₹12,500 crore, and HDB Financial Services is valued at around ₹61,253 crore. This is the full picture of HDB Financial Services. HDFC Bank’s support and backing will always remain a key strength for the company. And with its decent financials and strong market presence, it’s worth watching how this IPO turns out.

Also Read: How Franchising Is Fueling Indian companies