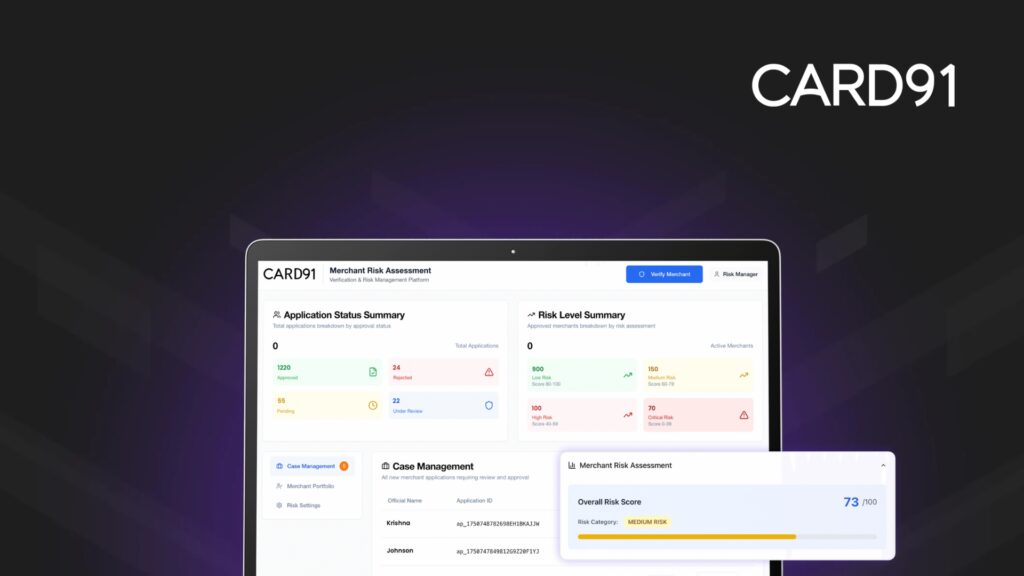

CARD91, a prominent payment infrastructure provider, has launched an AI-driven Merchant Onboarding, Verification, and Classification Suite. This secure and compliant solution is designed to improve onboarding processes, minimize fraudulent activities, and uphold regulatory standards for both banks and payment aggregators.

Using advanced AI/ML algorithms, the suite offers real-time risk evaluation, merchant authentication, and automated classification. This allows institutions to onboard merchants rapidly and with greater assurance.

CARD91’s CEO, Ajay Pandey, stated that fragmented processes and compliance issues have long troubled merchant onboarding. Their AI suite enables banks and aggregators to accelerate operations, decrease fraud, and maintain compliance, all while providing a smooth onboarding experience.

Key features include AI/ML Risk Assessment to classify merchants into risk categories, Comprehensive Verification using trusted data sources, Bulk Reclassification for misrepresented merchants, Smart MCC Mapping with natural language search, and Score-Based Limits based on risk scores. Streamlined DIY Onboarding enables secure, self-service flows with embedded verification and classification checks. The solution helps institutions mitigate risk by flagging high-risk merchants, protect revenue by preventing pricing errors, ensure AML/KYC compliance with RBI guidelines, improve efficiency by automating processes, and derisk portfolios by building a trustworthy merchant base.

The platform gathers merchant data with consent, confirms authenticity, assigns risk levels using AI models, and accurately maps MCC codes. Actionable risk scores inform decisions, with workflows to reclassify and configure limits dynamically. CARD91’s scalable suite is set to transform payment infrastructure. The Merchant Onboarding Suite is available for institutions aiming to modernize their operations.