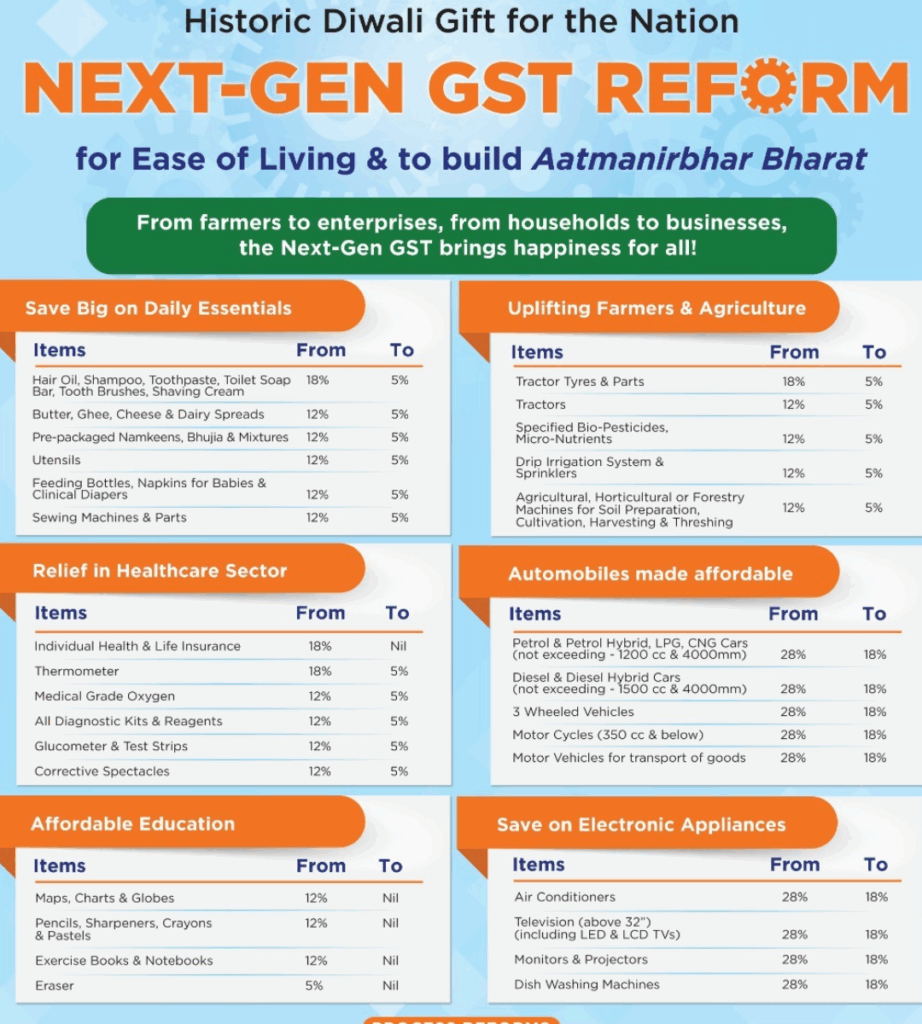

The 56th GST Council meeting introduced a sweeping overhaul of India’s GST structure, consolidating the previous five tax slabs (0%, 5%, 12%, 18%, 28%) into two main rates (5% “merit” and 18% “standard”) plus a special 40% demerit rate for sin/super-luxury items The changes – effective 22 September 2025 for most goods and services – were aimed at reducing the tax burden on the common man, farmers, and MSMEs. Key measures include full GST exemption for all individual life and health insurance policies, sharp rate cuts on many consumer goods, food items, agricultural equipment, and medical supplies, and a uniform 18% levy on auto parts Below, we organize the rate changes by sector, with tables listing only those items whose GST rates have changed.

New GST rates (effective 22 Sept 2025): two main slabs of 5% and 18%, with 40% for certain demerit goods. Previous GST was 0%, 5%, 12%, 18%, 28%.

This rationalisation was long overdue. Industry experts had often highlighted how multiple slabs led to disputes, classification errors, and compliance challenges. A leaner structure will not only bring predictability but also improve compliance efficiency

Relief for Insurance and Financial Services

All individual life and health insurance policies have been exempted from GST. The earlier 18% levy was often criticised for discouraging middle-class and low-income households from buying adequate coverage. By removing the tax, affordability of insurance is expected to rise. The move also aligns with India’s goal of improving insurance penetration, which still lags behind global averages.

Healthcare Sector Reforms

Medicines and medical goods saw major rate cuts. Thirty-three specified lifesaving drugs (commonly used in critical care) have been cut to 0%, down from 12%. Similarly, three specified drugs for cancer/rare diseases have moved from 5% to 0%. All other medicines (general drugs) have been cut from 12% to 5%. Medical and surgical instruments and diagnostic devices (e.g. X-ray machines, CT scanners, surgical apparatus, diagnostic kits, blood-pressure meters, etc.) have been cut from 18% (some were 12%) down to 5%

These reforms address one of the most sensitive concerns of Indian households: medical expenses. Reducing GST on healthcare inputs may also bring down treatment costs indirectly, though much will depend on how hospitals and distributors pass on the benefits.

Consumer Goods and FMCG

Everyday consumer products saw broad cuts. Items like hair oil, soaps, shampoos, toothbrushes, toothpaste, bicycles, tableware, kitchenware and similar household articles have moved from 12%/18% down to 5%. Major electronics/home appliances (“white goods”) also saw cuts: ACs, TVs, dishwashers dropped from 28% to 18% (slabs now 5% or 18%).

For FMCG firms, this could be a double win: lower taxes mean more affordability for consumers, and higher volumes could offset reduced margins. However, monitoring of MRP revisions will be critical to ensure consumers actually benefit from these reductions.

Food and Beverages

Basic food products have been largely spared from GST or moved to 5%. UHT (ultra-high-temperature) milk, pre-packed paneer (chhena) and Indian breads (chapati, paratha, khakhra, roti) have been cut from 5% to 0% (nil). Many packaged foods and staples have been reduced to 5% (from 12–18%). Butter and ghee (HSN 0405) moved 12% to 5%, cheese (0406) 12% to 5%, condensed milk (0402) 12% to 5%, instant pasta (1902) 12% to 5%, coffee & chocolate (0901/1806) 18% to 5%, cornflakes/breakfast cereals (1904) 18% to 5%, ready-to-eat snacks (namkeen 2005) 12% to 5%, and preserved meat products (1602/0210) 18% to 5%

This is a politically sensitive reform, as food inflation has often eroded household budgets. Reducing GST here is not only a consumer-friendly move but also a strategy to ease inflationary pressures in the short term.

Agriculture and Fertilizers

GST on farm inputs and machinery was cut sharply to support farmers. Tractors (HSN 8701) are taxed at 5% (down from 12%). Farm harvesters, threshers, balers, mowers, and similar agricultural machinery (mainly HSN 8433/8436) are now 5% (from 12%). Similarly, fertilizer chemicals saw deep cuts: sulphuric acid (HSN 2807), nitric acid (2808) and anhydrous ammonia (2814) are now 5% (from 18%). Agriculture remains the backbone of India’s economy, and lowering taxes here reduces farmers’ input costs. This move also corrects inverted duty structures that had long troubled agri-equipment manufacturers.

Labour-Intensive Industries

Certain labour-intensive manufactured goods were also lowered to 5%. Notably, handicrafts and artisan goods (various HSNs) are now taxed at 5% (down from 12%). Marble, travertine and granite blocks (HSN 2515) are 5% (from 12%), and intermediate leather goods (HSN 4112) are 5% (from 12%). These cuts ease the inverted-duty structure in these sectors.This decision supports employment-heavy sectors, especially MSMEs and artisan clusters. It signals that GST policy is being used not just for revenue, but also for socio-economic development.

Automobiles and Transport

Vehicles and transport equipment saw significant rate cuts to 18%. Small passenger cars (gasoline or diesel up to ~1200–1500cc, HSN 8703) are now 18% (from 28%). Motorcycles with engine ≤350cc (HSN 8711) are 18% (from 28%), while high-end motorcycles >350cc are increased to 40% (doubled from 28%) as a luxury/demerit levy. Buses, trucks and ambulances (HSN 8702/8704) are 18% (from 28%). Three-wheelers (HSN 8703/8711) move to 18% (from 28%). A uniform 18% rate applies to all auto parts (HSN 8708), down from 28%. Non-motorized bicycles (HSN 8712) and their parts (HSN 8714) have been cut to 5% (from 12%).

The auto industry, which contributes significantly to GDP and jobs, will benefit from these cuts. However, the steep rise to 40% on luxury motorcycles indicates a balancing act — relief for mass consumers, higher taxes for luxury demand.

Textiles and Apparel

Tax cuts corrected long-standing inverted duty issues in textiles. Man-made (synthetic) fibers (HSN 5406) are now 5% (from 18%), and man-made yarns (HSN 5407) are 5% (from 12%). This aligns yarn and fabric rates to support textile manufacturers.

This addresses a long-standing demand from the textile industry. Inverted duties had earlier made man-made fabrics costlier than cotton, hurting exports. This correction levels the playing field.

Construction and Building Materials

Cement and related products had their GST cut from 28% to 18%. For example, ordinary Portland cement (HSN 2523) is now 18%. Several specialty boards (e.g. cement-bonded particle board, fibre boards) were cut from 12% to 5%. Key example:

Since cement is a high-consumption material, this cut could significantly reduce construction costs. It is also likely to provide relief to the housing sector, which has been struggling with affordability concerns.

Services: Hospitality and Personal Care

On the services side, GST on hotel accommodations (rooms) costing up to ₹7,500 per day was cut from 12% to 5%. Personal care services for the common man (salons, barber shops, gyms, yoga/wellness centers, etc.) were cut from 18% to 5%

Tourism and personal care industries are expected to witness higher footfall due to affordability. For hotels in tier-2 and tier-3 cities, this could be a major demand booster.

Renewable Energy

As a boost to clean energy, renewable energy equipment and parts (e.g. solar/wind installations, HSN 8501/8502 etc.) were cut from 12% to 5%. This reform strongly aligns with India’s climate commitments. By lowering GST, renewable projects may become more financially viable, accelerating adoption.

The GST Reforms 2025 mark a decisive step towards a simplified, inclusive, and growth-oriented tax regime. Essential goods and services have been made cheaper, MSMEs and labour-intensive sectors have been supported, and compliance burdens have been reduced. The expected date of the new rates implementation is 22nd September, 2025

However, the success of these reforms will depend on effective implementation and whether businesses pass on the benefits to consumers. If executed well, these reforms could act as a catalyst for both economic growth and social equity.

Also Read: Platform Fees Explained: Why Indian Consumers Keep Paying Despite the Hikes?