The Indian startup ecosystem is booming like never before. Every week, we hear of new ventures raising millions, expanding globally, and redefining industries. Funding, innovation, and ambition are often credited as the driving forces behind this rise. But there’s one silent force that rarely gets the attention: the employees.

A visionary founder may have the idea, courage, and direction, but no founder can turn that vision into reality alone. It takes an army of dedicated employees working day and night, coding, designing, selling, and strategizing to bring that dream to life. They are the ones who build the product, delight the customer, and make the numbers move.

But in turn, what does the employee get? Salary? Do you think salary alone works for employees to dedicate their hard work, energy, and talent to help you build a billion-dollar company? Salary alone doesn’t fuel passion. It doesn’t inspire someone to work like the company’s success is their own.

To truly align employees with the founder’s vision, there has to be skin in the game, meaning a sense of ownership. But how can an employee feel like an owner of a company they didn’t start?

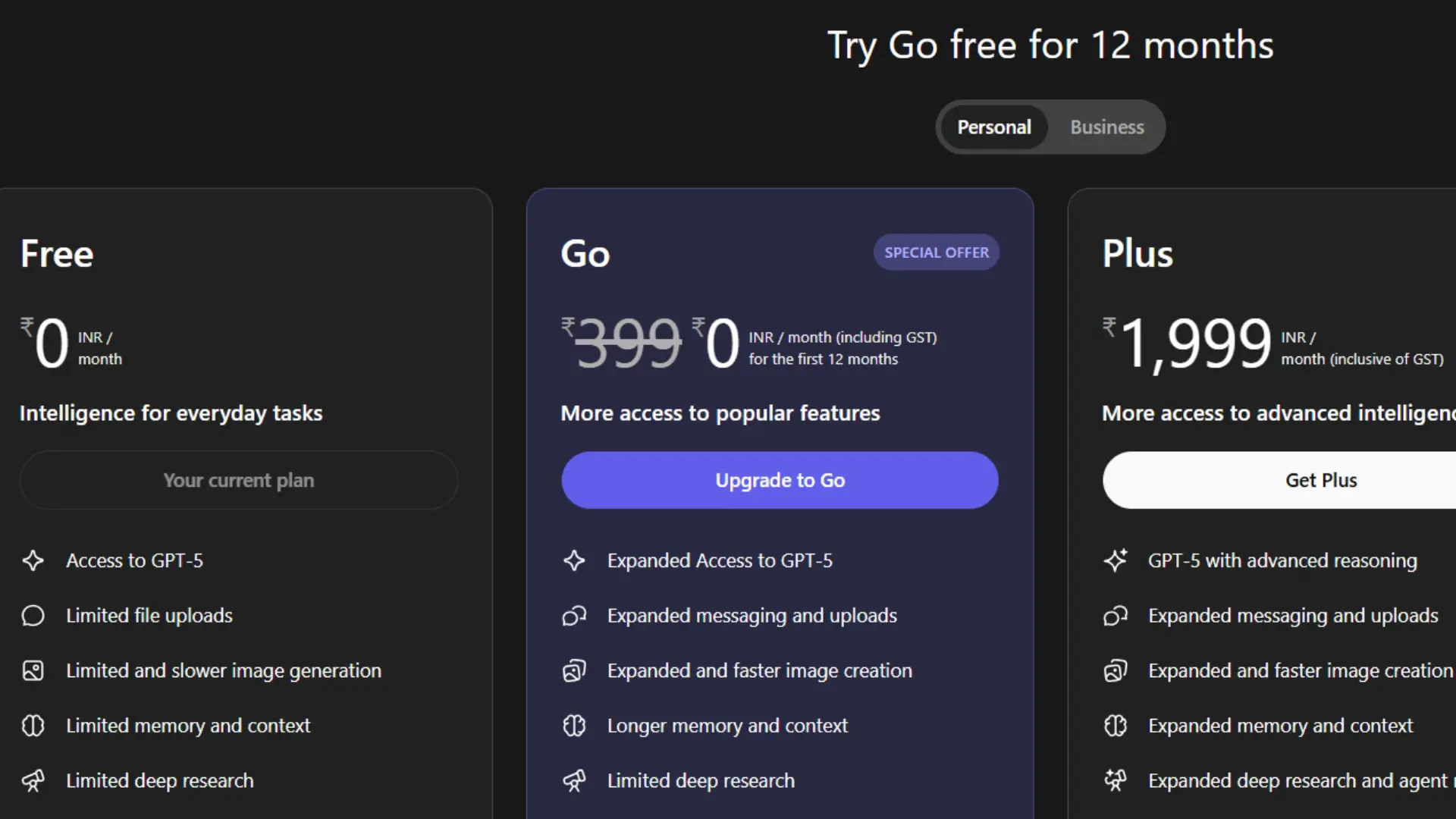

That is when the concept of ESOPS comes into action. ESOP stands for Employee Stock Option Plan, which is a mechanism that allows employees to own a small piece of the company they work for. In simple terms, ESOPs give employees the right (but not the obligation) to buy company shares at a fixed price after working there for a certain period. But this concept is a bit unique to understand.

Imagine you join a startup and receive 5,000 ESOPs at a price of ₹10 each. The company tells you these ESOPs will vest over four years. That means after your first year, 25% (1,250 options) become yours to exercise. After the second, another 25%, and so on until the full 5,000 options are vested after four years.

Now, let’s assume by the time your ESOPs fully vest, your company grows, and its share value rises to ₹200. You can buy your shares at ₹10 each (the exercise price) and later sell them for ₹200. That’s how the huge wealth will be created for you.

Now, startups are using this method to attract the top talent with ESOPs, and there are numerous examples of successful ESOP plans.

Now, this concept helps startups to acquire top talent and to compete with big corporations by offering high-quality professionals a long-term upside.

Now one of the biggest problems in startups is employee attrition. People get hired and fired easily, or they join fast and leave so fast.

So, when they give employees ESOPs, there are chances that employees remain in the company till the vesting period. The vesting period ensures that employees stay longer to fully realize their ownership. This builds loyalty and continuity in the team.

One of the biggest advantages of the startups is when they issue ESOPs that let startups preserve their cash reserves. Meaning they can pay higher salaries, but they are not paying in cash, which is a great advantage for the company.

But with these advantages, more startups are adopting this method. Earlier, ESOPs were confined to top executives in large corporations. But now, even young startups are granting ESOPs to early employees, interns, and key contributors.

This shift is one of the biggest reasons behind India’s thriving startup culture. ESOPs are helping founders attract and retain exceptional talent, while employees get to participate directly in the wealth creation they’re helping generate.

Companies like Freshworks, Zomato, Nykaa, Flipkart, and Razorpay have proven that when employees own a stake, they build with more passion, stay longer, and contribute to long-term growth.

Now let’s dive into some data points to understand the current wave of ESOPs. One of the best examples that we must talk about is Flipkart.

The company has built one of the largest ESOP pools in the country, worth over ₹17,000 crore, according to data from Longhouse Consulting reported by The Economic Times.

That’s huge wealth creation for its employees. During the time of the Flipkart acquisition, reports suggested that Flipkart employees collectively earned over $500 million through this buyout.

Not just that, even Zomato let’s consider. Zomato, for instance, conducted multiple ESOP buybacks and turned over 100 employees into millionaires during its IPO in 2021. Nykaa’s listing did the same, giving long-term employees huge wealth windfalls. Paytm and Oyo have also commenced large-scale ESOP programs, using them as both retention tools and reward systems.

In 2024, when Swiggy’s IPO unlocked a staggering $1 billion in wealth for over 5,000 employees. Out of these, 500 employees crossed the ₹1 crore mark.

That’s how Indian startups are creating wealth for employees and growing together. What do you think of this? Are ESOPs essential for building a successful startup?

Also Read: How Shadowfax Cracked India’s Toughest Problem: Last-Mile Delivery