Zynk, a company focused on reshaping global financial infrastructure, has successfully raised $5 million in seed funding. The round was led by Hivemind Capital, with participation from Coinbase Ventures, Alliance DAO, Transpose Platform VC, Polymorphic Capital, Tykhe Ventures, and Contribution Capital underscoring strong investor confidence in Zynk’s mission.

At its core, Zynk is designed to eliminate liquidity hurdles for payment firms, simplifying operations and enabling instant cross-border transactions. The company’s infrastructure currently supports multiple currencies, including the US dollar, euro, and Indian rupee, empowering remittance providers, B2B platforms, and trading networks to scale without liquidity-related constraints.

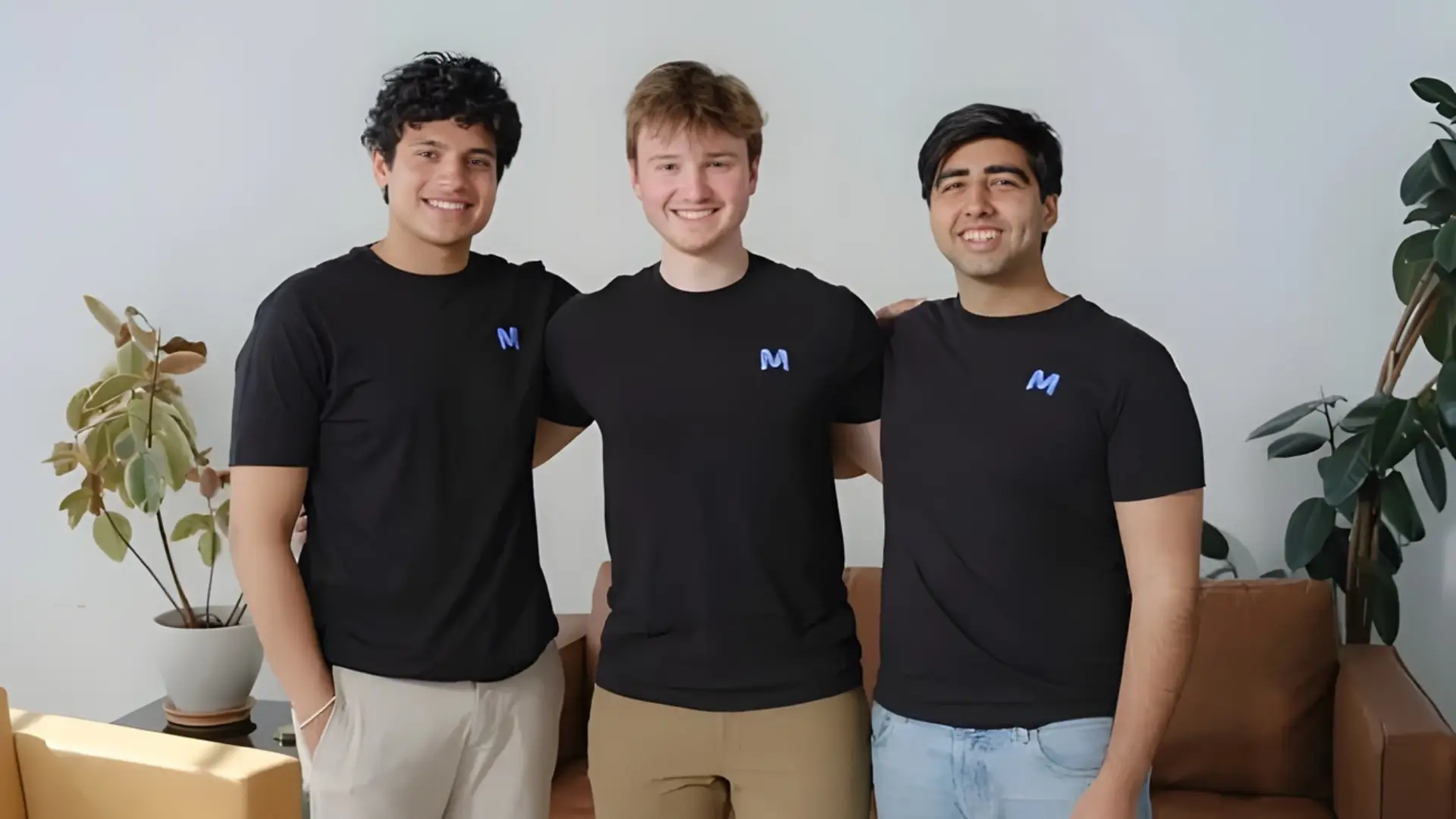

“Liquidity should move as freely as information,” said Manish Bhatia, CTO of Zynk. Prashanth Swaminathan, Co-founder and CEO, added that the new funding will help expand Zynk’s corridor coverage, enhance its compliance framework, and build partnerships with major global payment providers. “We’ve been building the financial pipes that make global payments instant,” he noted. “Access to just-in-time liquidity has become a moat in cross-border payments and we’re breaking that moat. Our mission is to make liquidity as mobile as data, freeing capital and eliminating idle balances, pre-funding, and manual treasury operations.”

The startup, which received early support from T-Hub, has been recognized for its global potential. Kavikrut, CEO of T-Hub, commented, “The Zynk team’s global mindset and depth of expertise make them a great example of how Indian innovation can power the world’s financial backbone.”

Also Read: Why Arattai Failed to Keep Users Despite Record Downloads?