Tiger Global’s complete exit from Ather Energy, where it held a 5% stake, is more than just a profit-taking move and it’s a reflection of a deeper transition in India’s startup and EV landscape.

The global fund, which invested around $12 million in 2015, sold its entire holding for about ₹1,204 crore, marking an impressive return. But the timing of this exit tells a larger story — India’s EV market is moving from venture-led growth to institutional stability.

For Tiger Global, this is about rotation of capital. After a decade of backing consumer internet and manufacturing-heavy startups, global investors are redirecting funds toward AI, software, and fintech, where scalability is faster and asset intensity is lower.

The EV sector, meanwhile, has entered a phase that demands patient, long-term capital — the kind that comes from strategic investors, corporates, and public markets, not VCs seeking rapid multiples.

This marks Tiger Global’s complete exit from Ather Energy. Earlier this year, the fund had partially offloaded 4 lakh shares in Ather’s offer-for-sale (OFS), realising ₹12.84 crore. Based on its 2015 entry price, the latest sale represents an estimated 8.3x return per share, though not on the overall investment.

Meanwhile, Ather Energy continues to post solid growth. As per Vahan data, registrations rose 53% in October to 28,061 units, giving it a 19.5% market share, behind only TVS Motor and Bajaj Auto.

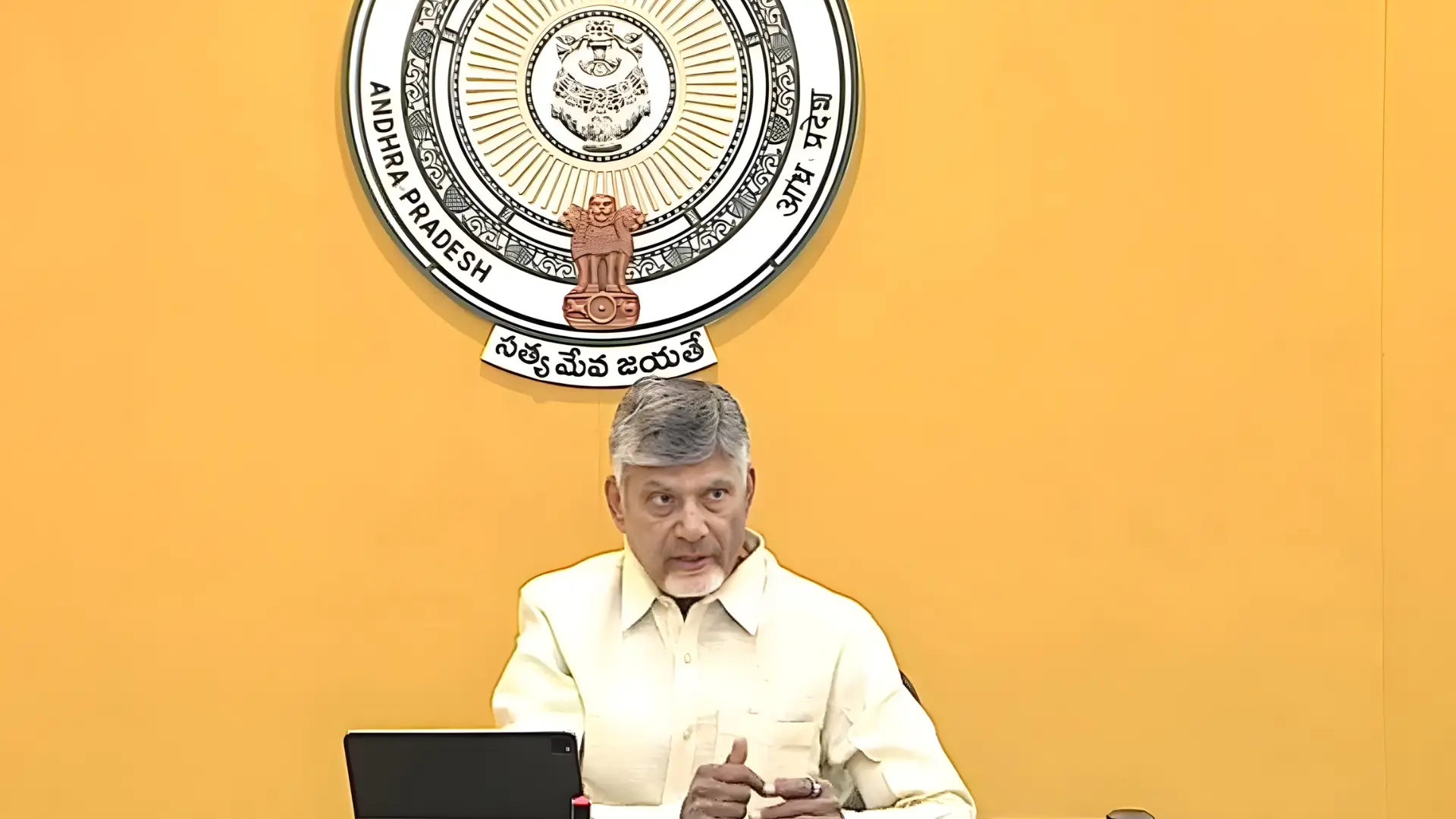

Also Read: Andhra Pradesh approves INR 1.02 Lakh Crore in investments, potentially creating 85,870 jobs