Reo.Dev raises $4M Seed funding to expand its team and enhance product development

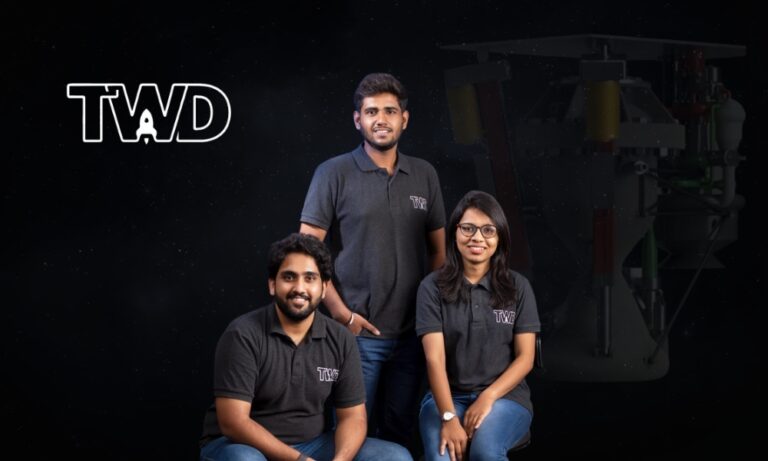

Reo.Dev raised $4 million in seed funding led by Heavybit, with India Quotient and Foster Ventures participating. Founded by Achintya Gupta, Gaurav Jain, and Piyush Agarwal, funds will expand the team, establish a U.S. office, and enhance products. The AI-native GTM platform interprets developer signals from GitHub, providing sales and marketing insights. Over 100 companies, including Chainguard and LangChain, use Reo.Dev.